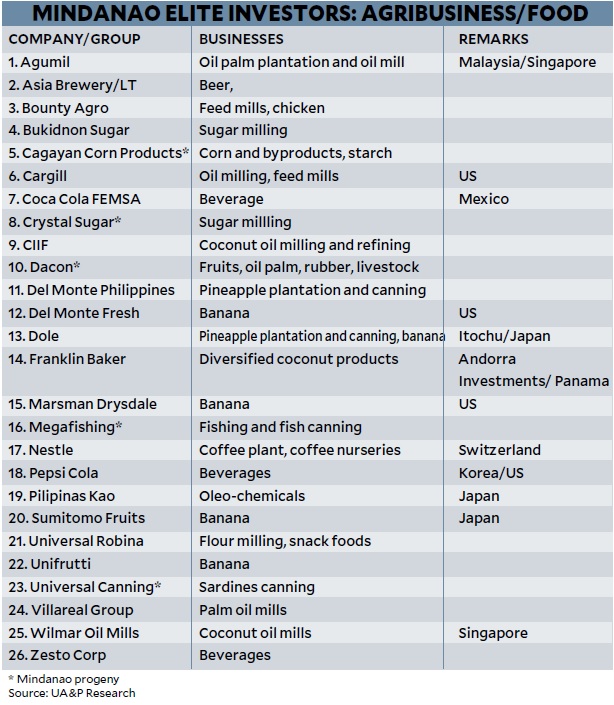

Some 60 companies/groups (an incomplete list) have invested more than P1 billion each in the region. About 26 have focus in agribusiness; others are into diversified businesses (11); property and retailing (11); and mining, power, manufacturing and services (12).

This article’s goal is to discuss the major movers in the region. What are the main takes from the list?

First, of the 60, only 17 are foreign investors: Agumil Group, Cargill, Coca Cola FEMSA, Del Monte Fresh, Dole, Franklin Baker, LafargeHolcim, Marsman-Drysdale, Nestle, Pepsi Cola, Philippine Sinter, Pilipinas Kao, Sumitomo Fruits, STEAG State Power, Taganito HPAL, TVI and Wilmar Oil Mills (coconut). This debunks the claim by some sectors that Mindanao is dominated by multinationals. Del Monte Philippines is owned by the Campos Group. It is an entirely different company from Del Monte Fresh, United States.

Second, 17 on the list have true Mindanao progenies: Anflocor, Alsons, Cagayan Corn Products, Crystal Sugar, Dacon, Dominguez, Felcris, Hijo Resources, KCC, Limketkai, Lorenzo, Megafishing, Phoenix Petroleum, Pryce Corp., NCCC, RD Group and Universal Canning.

Agribusiness groups

The largest agribusiness groups include Del Monte, Dole and Dacon. Del Monte runs the world’s largest integrated pineapple operation in the world. Dole-Stanfilco, Sumitomo Fruits, Unifrutti, and Tadeco, part of the diversified Anflocor group, are large banana exporters.

Seven out of 12 investors have Mindanao progenies. They are Alsons, Anflocor, Dominguez, Hijo Resources, Limketkai, Lorenzo and RD. Alsons, Anflocor, Filinvest, Limketkai, RD, San Miguel and SM have investments of way over P10 billion.

Property and Retailing

The sector is spread out among Mindanao progenies (i.e., Felcris, KCC and NCCC) and “migrants” (i.e., Aeon, Ayala, DMCI, Gaisano, Robinsons, Villar).

Mining, Manufacturing, Power and Services

This is a mix of industries with local and foreign investors. They include Apex Mining, BDO, Energy Dev’t Corp. (EDC), ICTSI, Philippine Sinter, Phoenix Petroleum, STEAG State and TVI.

Mindanao is “new territory” for first-time investors. The locals are expanding despite “threats.” Veteran foreign investors are also engaged. But the “outsiders” are hesitant to thread Mindanao waters for security reasons. One option is to have an established and trusted “local” as partner who is a seasoned operator in the region.

With the current administration’s peace initiatives, hopefully, more investments will flow that will create jobs and help address Mindanao’s extremely high poverty.

The article reflects the personal opinion of the author and does not reflect the official stand of the Management Association of the Philippines or MAP. The author is the vice chair of the MAP Agribusiness and Countryside Development Committee, and the executive director of the Center for Food and Agribusiness of the University of Asia & the Pacific. Feedback at map@map.org.ph and rdyster@gmail.com. For previous articles, please visit map.org.ph