Rates rose for the term deposits offered by the Bangko Sentral ng Pilipinas on Wednesday but banks and trust institutions continued to park funds in the facility that was aimed at mopping up excess liquidity.

Tenders hit P211.2 billion, almost double the P110-billion offering at the term deposit facility (TDF) auction.

For the P10 billion in seven-day term deposits, P30.9 billion was tendered.

As for the 28-day facility, the BSP fetched P180.3 billion in bids for the P100-billion offering.

The accepted yields rose to 2.5-2.525 percent for the seven-day and 2.5-2.7 percent for the 28-day facility.

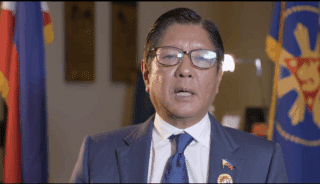

Last week, BSP Governor Amando M. Tetancgo Jr. said they “continue to see good interest in the auction facilities.”

“While the average rates have inched up for both the seven- and 28-day auctions, the increments have been minimal. The bid-to-cover ratios have remained broadly unchanged, indicating there could be room for further adjustments in the auction sizes for future auctions,” Tetangco said.

For the next auctions on Nov. 2 and 9, the BSP will offer a higher P130 billion in term deposits—P120 billion in 28-day and P10 billion in seven-day.

Operational adjustments had been made by the BSP ahead of the implementation of the interest rate corridor (IRC) aimed at bringing market interest rates closer to the policy rate.