Stock tax hike plan worries market

The Philippine Stock Exchange and its member stock brokers are worried about a proposal of the new administration to double the stock transaction tax to 1 percent, saying this would make the local stock market less attractive.

An increase in the stock transaction tax, currently at 0.5 percent, forms part of the tax policy reform under consideration in lieu of capital gains tax. This is among the “offsetting” measures being considered as the government seeks to lower personal and corporate income taxes.

“I think you’ll find that financial market volumes act in the opposite direction of friction costs, taxes included. If the government lowers friction costs, including stock transaction tax, to be more competitive in the Asean (Association of Southeast Asian Nations) and Asia, they are likely to collect more nominally because flow increases,” PSE president Hans Sicat said in a text message.

The Philippine Association of Stock Brokers and Dealers Inc. (Pasbdi) also opposed the proposed increase in the stock transaction tax.

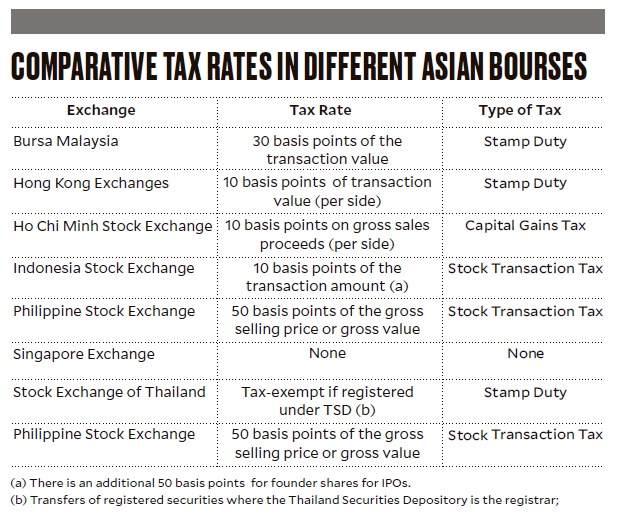

“That’s a 100-percent rise. At the current sales tax level of 0.5 percent, the Philippines already has one of the highest all-in costs of transactions in the stock market in the Asia,” Pasbdi president Ismael Cruz said in a text message.

Article continues after this advertisement“A person who understands the workings of capital markets will agree that lower transactions costs will positively result in higher volumes and enhanced liquidity which brings about higher tax collection in the end,” Cruz said.

Article continues after this advertisementStock transactions at the Bursa Malaysia are charged with only 30 basis points of the transaction value in the form of stamp duty. At the Hong Kong Exchanges, such transactions are charged with only 10 basis points of the transaction value. In Vietnam, a capital gains tax equivalent to 10 basis points of gross sale proceeds is levied on transactions through the Ho Chi Minh Exchange.

Indonesia also imposes a stock transaction tax equivalent to only 10 basis points of the transaction amount. Another 50 basis points charged on founder shares of companies doing an initial public offering (IPO).

Singapore, a key financial center in the region, does not impose any stock transaction tax. Thailand also exempts stock transactions from taxes if they involve registered securities where the Thailand Securities Depository is the registrar.

Securities and Exchange Commission Chair Teresita Herbosa is in favor of modestly raising the stock transaction tax.

“We have to balance things. If we do away with IPO tax then we probably have to increase stock transaction tax even a little,” she added.

Herbosa also favors the simplification of capital market tax rates, which vary for residents and non-residents as well as for securities with different tenors.

“Increasing friction costs are a deterrent to activity. Empirical results all over demonstrate this. The previous administration’s move to add a transfer tax on REITs (real estate investment trusts) demonstrate the ability of such a move to kill a product and transaction flow. They have collected exactly zero in the last two and a half years on this product as a result,” Sicat said.

REIT gives investors the option to invest directly in the finished products that are already earning money—such as residential and office units, hotels or shopping malls or even infrastructure ventures like toll roads and power plants—and not just in the property developer. This was meant to attract investors because the law requires the distribution of 90 percent of the concerned projects’ or products’ income yearly.

Under the Aquino administration, the REIT did not take off due to regulations that were even more stringent than what the law prescribed. The high public float requirement was among the constraints cited by investors. Investors were also wary on the imposition of the 12-percent value-added tax (VAT) on initial asset transfers, which was expected to translate to significant upfront costs. Another REIT regulation that has been disconcerting to investors is the requirement that tax savings arising from fiscal incentives be placed in escrow, which would be taken back by the government if and when the REIT falls below the required public ownership and gets delisted.