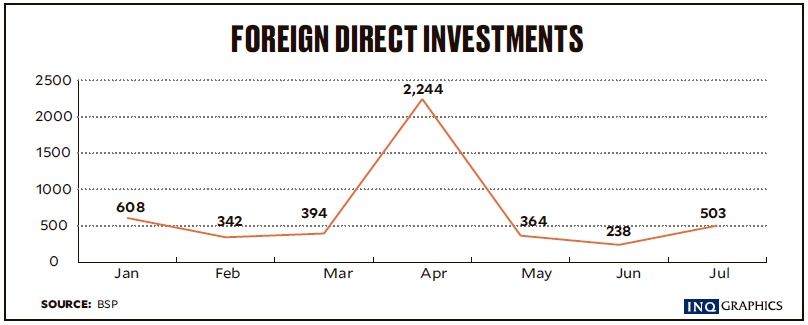

The net inflow in July was 7-percent higher than the $470 million recorded a year ago. It also exceeded June’s $238 million and May’s $364 million, although lower than the $2.244 billion recorded in April, Bangko Sentral ng Pilipinas data released Monday showed.

At the start of the second half, foreign investments in debt instruments or intercompany borrowings, which accounted for the bulk of FDIs, jumped by almost 80 percent to $417 million from $232 million last year.

Equity capital other than reinvestment of earnings reached $23 million, as placements of $46 million outpaced the $23 million in withdrawals.

The net inflow in equity capital last July reversed the net outflow of $5 million in June but was 85.5-percent lower than the $159 million registered a year ago.

The BSP said gross equity capital placements came mostly from Germany, Japan, Singapore, South Korea and the United States.

Equity capital was mainly infused into the following sectors: construction; financial and insurance; manufacturing; real estate, and wholesale and retail trade.

However, reinvestment of earnings dropped by almost 20 percent to $63 million in July from $79 million a year ago but higher than the $62 million in June.

At the end of the first seven months, net FDI inflows hit $4.695 billion, up 79.1 percent from $2.621 billion in the same period last year.

“The increase in (year-to-date) FDI inflows was driven by investors’ positive outlook on the Philippine economy, reinforced by strong macroeconomic fundamentals,” the BSP said in a statement. The Philippine economy grew 6.9 percent in the first half, among the fastest in Asia.

The average economic growth of 6.2 percent in the first five years of the Aquino administration was the fastest since the late 1970s such that the Philippines was no longer regarded “the sick man of Asia” but the region’s “rising star.”

Net debt instruments climbed by 111.2 percent year-on-year to $2.781 billion.

As of July, net equity inflows other than reinvestment of earnings grew 74.7 percent year-on-year to $1.468 billion, as the $1.657-billion placements exceeded withdrawals worth $189 million.

Reinvestment of earnings during the seven-month period, however, slid 3.9 percent year-on-year to $446 million.

The top sources of equity capital placements from January to July were Hong Kong, Japan Singapore, Taiwan and the US.

The end-July FDI flows were primarily poured into accommodation and food service activities, construction, financial and insurance, manufacturing and real estate.