PSEi falls to 7,600 on telco, ECB woes

THE LOCAL stock barometer fell to the 7,600 mark on Wednesday on local telecom woes alongside regional jitters over the possible tapering of European monetary stimulus.

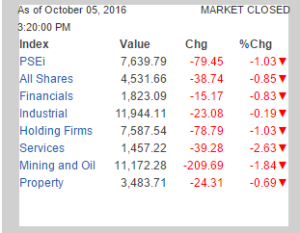

The Philippine Stock Exchange index lost 79.45 points or 1.03 percent to close at 7,639.79.

All counters ended in negative territory but the most battered was the services sub-index which fell by 2.63 percent. PLDT fell by 4.59 percent while Globe tumbled by 3.68 percent as they face massive fines from the Philippine Competition Commission in relation to the deal to buy out San Miguel group’s telecom assets.

The holding firm and mining/oil counters slipped by over 1 percent.

Total value turnover amounted to P6.4 billion. There were 127 decliners which overwhelmed 58 decliners while 43 stocks were unchanged. There was P324 million in net selling among foreign investors.

Security Bank fell by 2.67 percent while GT Capital, Metrobank, SM Prime, Ayala Corp. and JG Summit all declined by over 1 percent.

BDO and Jollibee also slipped.

Notable decliners outside the PSEi were Global Ferronickel (-4.67 percent), Nickel Asia (-3.85 percent) and Cemex (-1.17 percent).

On the other hand, ALI, MPI and BPI bucked the day’s downturn. They all eked out modest gains.

Elsewhere in the region, stock markets were mostly lower on reports that the European Central Bank (ECB) would reduce its monetary stimulus.

“A Bloomberg report that the ECB is building consensus to taper its QE (quantitative easing or massive bond-buying) program has hit market sentiment overnight. Given that the consensus probably viewed an extension of the QE program as the more likely outcome, this report serves a remarkably hawkish surprise,” Citigroup said in a research note.

“Following on from the Bank of Japan’s policy maneuvers earlier, such a shift from the ECB would likely confirm the end of experimental and extreme monetary easing in the G3 (three wealthiest economies- US, Japan and EU). Notably, in the US too we have continued to receive a parade of hawkish guidance from Fed (US Federal Reserve) speakers,” it said.