The local stock barometer firmed up above the 7,500 level Monday, tracking the upswing in oil prices that perked up regional markets ahead of the upcoming US Federal Reserve meeting.

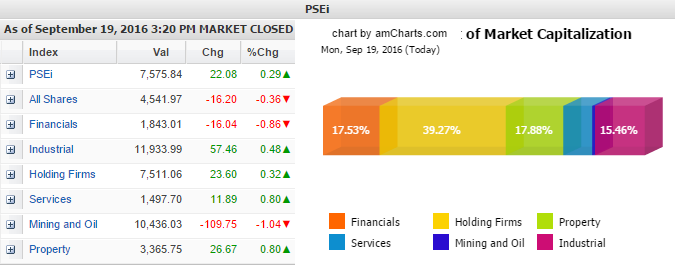

Overcoming a rough start, the Philippine Stock Exchange index (PSEi) added 22.08 points or 0.29 percent to close at 7,575.84 even as foreign investors continued to dump local equities.

“Much has been said about foreign selling since last month, though one quality separates this time’s outflows compared to before—magnitude. Foreign funds have sold an average of $23.1 million or P1.1 billion per day since Aug. 12, 2016. For reference, the taper tantrum of 2013 brought an average of $7.3 million of selling per day. The past month has actually seen the fastest foreign fund outflow for the index since the start of our data in 2005,” Papa Securities said in a research note issued Monday.

The stock market had been in the doldrums for the last six weeks. Monday, foreign investors were still in a net selling position amounting to P885 million but domestic investors made up for the slack. Value turnover for the day amounted to P7.21 billion.

“On the other hand, considering that quarter-end window-dressing is just around the corner, we might see an inflection within this week,” Papa Securities said. “We expect a rally until the end of the quarter; after that, the market will look toward outside markets such as the DJIA (Dow Jones industrial index) for direction.”

Despite the PSEi’s gain, market breadth was negative as buyers mostly targeted large-cap stocks. There were 90 advancers, which were outnumbered by 101 decliners, while 47 stocks were unchanged. Doris Dumlao-Abadilla