Key steps toward genuine tax reform in PH

Genuine tax reform for inclusive growth does not end with the lowering of personal and corporate income tax rates.

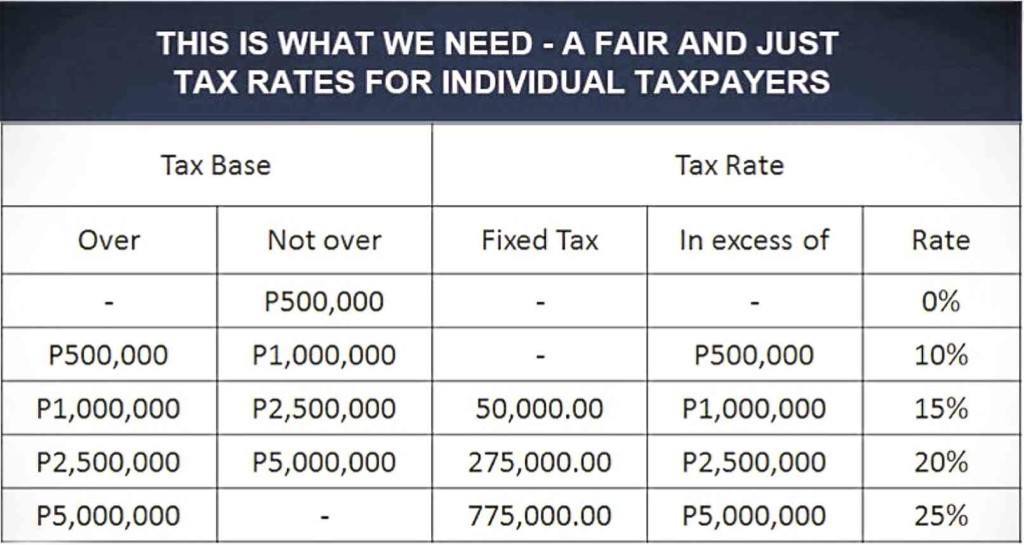

But lowering the personal income tax rate to 25 percent from 32 percent is fair and necessary for us to be competitive, considering that 25 percent is the average income tax rate in the Association of Southeast Asian Nations.

The table here shows my version of the revised personal income tax table exclusive for employees that we can already adopt next year.

With that in place, here are other steps that I hope the government will take to push genuine tax reform for inclusive growth.

1. Broaden the taxpayer base

Declare a tax holiday to register all business entities belonging to the underground economy, from marginal income earners like sari-sari store owners to freelancers and professionals.

The goal is to increase the less than 15 percent registered individual taxpayers of the estimated 104 million population of the country to at least 30 percent or more than 30 million registered taxpayers;

2. Implement the Philippine Business Registry via one-stop-shop business registration

The Negosyo Centers should be able to register most if not all MSMEs that are already registered with the barangay and/or the local government unit.

The target is to include everyone in the database, whether they are income tax exempt or not, so that the BIR can adopt specific programs to assist taxpayers and make it easy for them to comply with regulations;

3. Share data with the Professional Regulation Commission (PRC) and Securities and Exchange Commission (SEC) to close the taxpayer gap among licensed professionals who are not registered with BIR and those dummy corporations registered with SEC (that either buy and sell properties or receipts without paying taxes);

4. Organize nationwide tax awareness roadshows with the Department of Trade & Industry (DTI) to assist all micro and small entrepreneurs through the Revenue District Offices (RDO) of BIR and Negosyo Centers of DTI;

More importantly, a review of the size, industry and classification of taxpayers must be undertaken to double or triple the number of large corporations handled by the Large Taxpayer Services (LTS) unit that account for 65 percent of total income tax collection;

5. Allow abatement or legal compromise to all delinquent and pending tax cases, which may only be subject to “illegal compromise if further prolonged in the custody of BIR”;

6. Lift the bank secrecy law for legitimate tax investigations or assessments but caution must be observed as corruption is embedded in the current tax system.

If examiners will not be accountable for the assessments they make, they may continue issuing unreasonably high assessments without basis or almost impossible to settle as these can sometimes go beyond the net worth or available resources of companies being assessed.

7. Implement a tax amnesty in Davao to assess its impact on revenue collection before declaring a nationwide tax amnesty for all taxes. This is to ensure all leaks and possible abuses will be dealt accordingly before its full implementation covering 2015 and prior years;

8. Complement the tax amnesty, which will give taxpayers a second chance to pay the right taxes, with a certification program like the Citizen Tax Planning (CTP), which CSR Philippines is providing to taxpayers who have been harassed or assessed regularly by BIR.

A “Seal of Honesty” is awarded after three years of strategic tax planning that guarantees an increase in voluntary compliance without BIR audit.

This is in partnership with Integrity Initiative that has signed more than 3,000 companies to the Integrity Pledge.

If at least 10 percent or 300 companies will undergo Citizen Tax Planning with a commitment to increase voluntary compliance, all possible revenue losses from the lowering of income taxes will be covered;

9. Suspension of audit is a good start, but it may not be sustainable. Instead, a risk-based, computer-assisted audit with industry profiling and benchmarking must be implemented for medium to large corporations.

The Run After Tax Evaders (RATE) must be re-engineered to catch real big time tax evaders and smugglers. Today, almost 500 tax evasion cases have remained unresolved.

10. Definitely, exempt BIR from Salary Standardization Law to attract top-caliber CPAs and lawyers.

(The author is a former BIR examiner and an advocate of genuine tax reform. He is one of the 2015 Ten Outstanding Young Men (TOYM) of the Philippines. This year, he joins the Top 20 Finalists for the 2016 Ten Outstanding Young Persons (TOYP) of the World. Vote for him at www.jci.cc/toypvote to become part of the 10 TOYP Honorees. For inquiries, e-mail him at consult@acg.ph.)