Peso, stocks cheer peaceful elections

The local stock barometer rallied back to the 7,100 level Tuesday as investors cheered the relatively peaceful May 9 presidential elections.

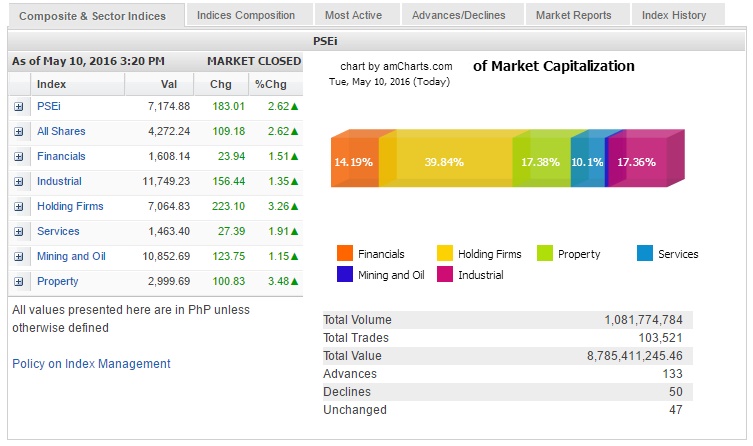

The main-share Philippine Stock Exchange index (PSEi) rose 183.01 points or 2.62 percent to close at 7,174.88, likewise tracking upbeat regional markets.

“Regionally, the Philippines followed the rest of Asia as Japan resumed trading after the Golden week,” said Luis Gerardo Limlingan, managing director at Regina Capital Development. The Golden Week refers to four national holidays clustered within seven days in Japan, making this one of the busiest holiday seasons in that country.

“Investors are also relieved that [the election] process has been peaceful and free of widespread cheating and that the main protagonist has a commanding lead, paving for a peaceful transition,” Limlingan said.

Based on the latest unofficial count, Davao City Mayor Rodrigo Duterte already had an insurmountable lead.

“He doesn’t have an economic plan but he said he will copy [the plan of the other candidates]. That’s fine,” said Joseph Roxas, president of Eagle Equities Inc.

Roxas said a lot of people had already trimmed their stocks holdings due to the usual jitters ahead of the elections.

“They feared there would be violence but there’s none. You can’t beat a landslide [support],” he said.

The peso also returned to the 46:$1 level Tuesday, a day after the elections, to close at 46.75:$1.

Tuesday’s close was a rebound From 47.09 to $1 last Friday. Markets were closed Monday as elections were held for the country’s top elective government posts.

Financial markets welcomed the speedy counting of votes, the emergence of winners in most local governments as well as some clarity on who would occupy the highest post in the land.

At the Philippine Dealing System, the peso hit an intraday high of 46.75 and a low of 47.20 to $1, the opening rate.

The total volume traded rose to $824.65 million from $725 million at the end of last week.

Limlingan said the local market was also buoyed by the rebound in Asian markets.

“Japanese shares rose by the most in three weeks as the yen extended its decline, boosting the profit outlook for exporters, and investors bought stocks in companies posting positive earning results. Chinese stocks in Hong Kong headed for their first gain in seven days as financial companies advanced,” he noted.

At the same time, Limlingan noted that the Hang Seng China Enterprises Index had climbed 0.3 percent, paring losses while the Shanghai Composite Index had closed little changed after data showed China’s consumer prices rose for a third month while factory gate deflation narrowed more than expected.

Property stocks RLC and SM Prime led the PSEi higher, respectively surging 8.61 percent and 5.96 percent. SM Prime was the day’s most actively traded stock.

JG Summit gained by 5.36 percent. Megaworld and AEV both rallied more than 4 percent while SMIC and AC rose over 3 percent. PLDT, MPIC and BPI all advanced more than 2 percent while ALI, Metrobank, Jollibee and Globe gained over 1 percent.

Outside of PSEi stocks, URC and GTCAP also contributed to the day’s gains.