The local stock barometer rallied past the 7,000 mark on Thursday as investors anticipated more monetary stimulus from major central banks.

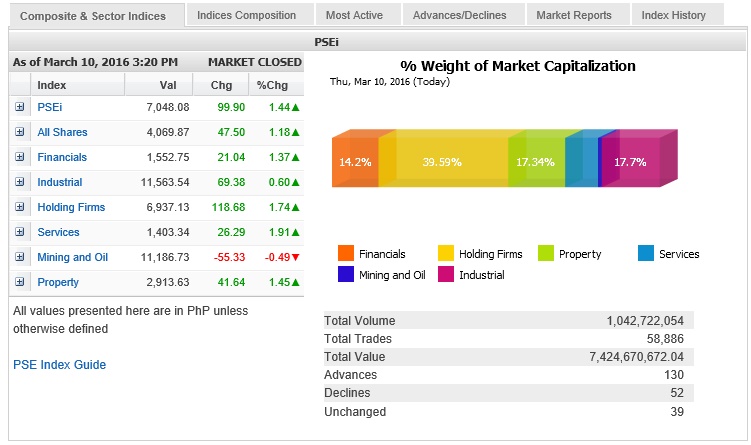

The Philippine Stock Exchange index added 99.9 points or 1.44 percent to close at 7,048.08, rising for the third straight session.

“I think the euro (zone) is going to make interest rates even more negative,” said Joseph Roxas, president of stock brokerage Eagle Equities.

At present, rates are below zero in the euro zone and Japan. Negative interest rates mean that depositors pay to park their money in the central bank or in the retail banks. Such a policy intends to encourage more productive lending to stimulate the economy.

“They are thinking of increasing the disincentive (to keep funds idle in banks) even more,” Roxas said.

“I think this is still that flight to safety strategy as investors who are exiting PLDT from last week are seeking safer haven stocks like SM on size alone. ALI also benefiting,” said Jose Mari Lacson, deputy head of research at BPI Securities.

When interest rates are negative in

developed markets, investors seeking better yields are thus seen looking at well-performing emerging markets.

Many investors deem the Philippines among those attractive markets with relatively good fundamentals.

The gains were led by the financial, holding firm, services and property counters, which all surged by over 1 percent. The industrial counter was likewise slightly higher in Thursday’s trade. Doris Dumlao-Abadilla