THE LOCAL stock barometer rebounded on Tuesday as China’s fresh stimulus and higher fixing of the yuan perked up regional markets.

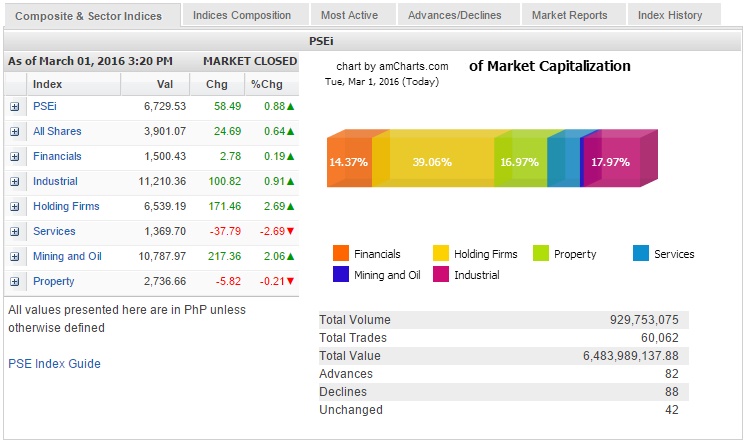

The Philippine Stock Exchange index recouped 58.49 points or 0.88 percent to close at 6,729.53. Investors continued to digest the stream of local corporate earnings reports.

The day’s gains were led by the holding firm and mining/oil counters which both rose by over 2 percent while the financial and industrial counter also firmed up.

On the other hand, the services counter fell by 2.69 percent, dragged down by PLDT, which dropped by another 4.1 percent as investors priced in a decline in earnings for the next three years. Rival Globe Telecom also slid by 4.75 percent.

Total value turnover amounted to P6.5 billion. Despite the PSEi’s gain, there were slightly more decliners (88) than gainers (82) in the broader market.

The PSEi was led higher by SMIC, which rose by 6.95 percent following the announcement of its 2015 results and the consolidation of retail businesses under one roof.

MPIC also rose by 4.31 percent after posting a 22 percent growth in core profit for 2015.

Meralco added 2.15 percent while Jollibee and AP gained over 1 percent.

URC, BDO, AC and Metrobank also firmed up.

One notable decliner was SSI, which tumbled by 8.57 percent.

Across the region, regional markets drew strength from news that China’s central bank had agreed to slash the reserve requirement ratio banks on banks by 50 basis points.

At the same time, a weak factory report in China for February boosted expectations of further monetary stimulus.

“To offset countercyclical growth headwinds and supplement excess capacity reduction, we expect policy easing to step up,” American investment bank BofA Merrill Lynch said in a research note on Tuesday.

“We maintain our call for two rate cuts, coupled with fiscal expansion and other countercyclical easing measures.”