Asean integration, will it lead to a tax war in the region?

ONE OF the cornerstones of the Asean economic integration (AEI) is to make the Asean region a single market and production base characterized by the presence of the five freedoms—free flow of goods, services, capital, labor and investments within the Asean region—and make it fully integrated in the world economy.

To achieve these five freedoms, Asean states are now working to harmonize their laws (to a certain extent), rules and practices, removing the differences and aiming to offer a single platform.

But in all these ongoing efforts for harmonization, little is said about taxation.

The AEC Blueprint does not require transformative tax measures nor tax harmonization. The reason is clear. Taxation is an act of sovereignty, something beyond the bounds of what an international body could dictate and AEC cannot divest a member country of its basic right to determine the level of income and expenditures it so desires. The wide disparity in the level of economic development of the Asean member-countries (AMCs) makes it even more hopeless to aspire for a harmonized taxation in the region.

Thus, tax will remain a powerful tool for each AMC to attract investments.

As each member country tries to grab a bigger share of the so called “investment pie,” AMCs will use taxation as leverage and this will eventually lead to the lowering of taxes in the region.

Article continues after this advertisementA tax war will happen and this will characterize the AEC era.

Article continues after this advertisementThe good thing about this is that it will drive taxes low, but the bad thing is that it will cause the national treasury to bleed.

Regional tax war has begun

A tax war is now apparent in the region. In preparation for Asean integration, Malaysia and Thailand already reduced their corporate income taxes (CIT) beginning 2016, the official start of AEI. Malaysia reduced CIT from 25 percent to 24 percent while Vietnam reduced it from 22 percent to 20 percent.

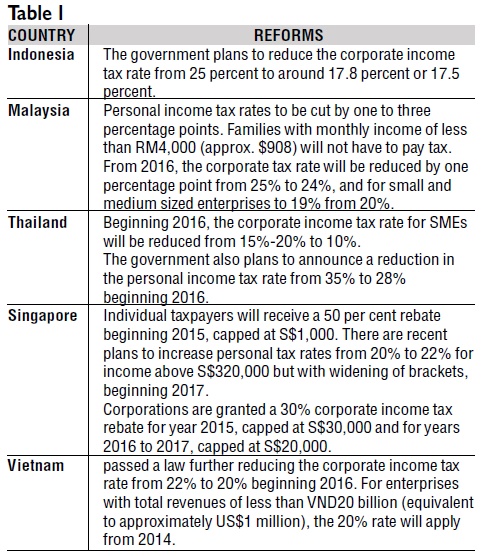

Ongoing proposals for the reduction of both personal income tax (PIT) and corporate income taxes (CIT) are also being undertaken in the other member states. Table 1 shows the ongoing tax reforms in selected five (5) AMCs:

In the Philippines, there are also attempts to lower the corporate rates to 25 percent and the top PIT rates to 25 percent but all efforts failed.

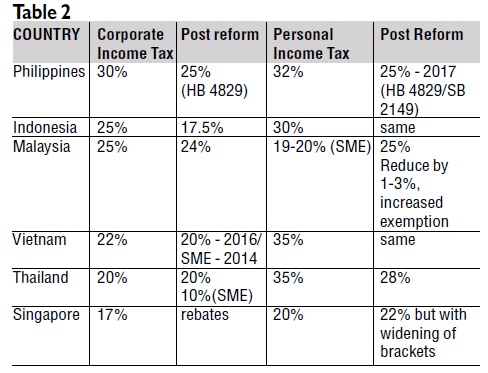

Table 2 shows the landscape of the taxation in the region post reforms.

Table 2 shows the beginning of a tax war in the Asean region. The tax competition is expected to continue.

Where does Philippines stand?

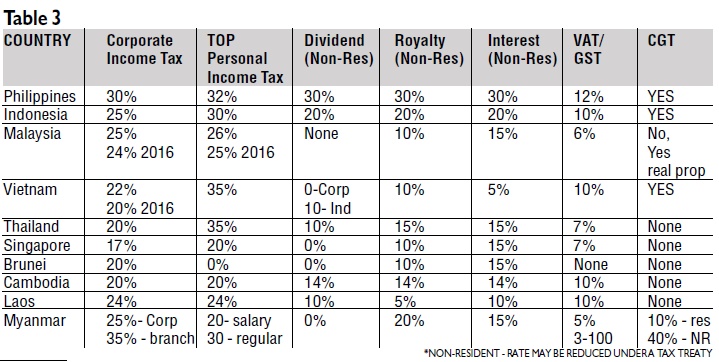

As it is now, the Philippines has consistently ranked as having the highest tax rate in the region on all types of taxes. Table 3 clearly shows this.

Clearly, the Philippines is an outlier in the region with the highest tax rate imposed on all types of tax on income.

And when the rate cut in other AMCs kicks in, this will put the country further away from the rest of the region when it comes to taxes.

I need not explain more but with the current tax structure we have, we will not only lose the race for new investments but it will also be difficult for us to retain those we have right now.

Now is the time to seriously consider a genuine tax reform. With all the developments happening in other Asian member countries, if we do nothing to reform our current tax system, we will die in the battlefield with eyes wide open.

(The author is the Chair of the Tax Committee of the Management Association of the Philippines (MAP), and the Managing Partner and CEO of the Du-Baladad and Associates [BDB Law]. Feedback at <[email protected]> and <[email protected]>. For previous articles, please visit <map.org.ph>)