THE LOCAL stock barometer rebounded to the 6,200 level after a tumultuous week on Friday as hopes for central bank stimulus perked up regional markets.

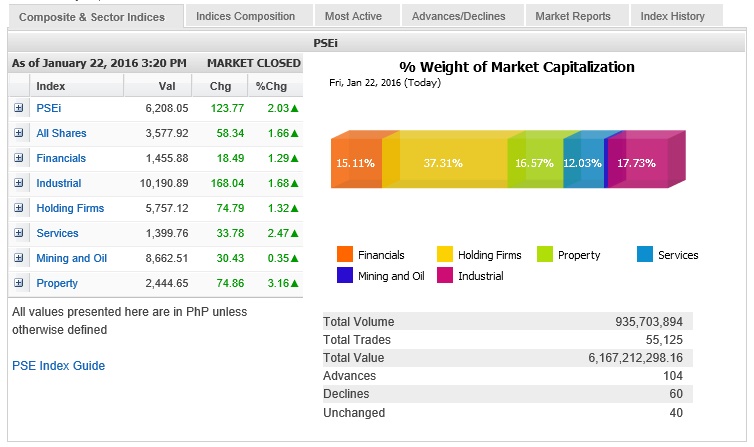

The main-share Philippine Stock Exchange index recouped 123.77 points or 2.03 percent to close at 6,208.05. This narrowed weekly losses to 241.45 points or 3.7 percent.

The index has languished in “bear” territory for the second straight week, having fallen by over 20 percent from the peak levels seen in April 2015.

On Friday, all counters were up but the rebound was led by the interest rate-sensitive property counter which advanced by 3.16 percent.

The services counter rose by 2.47 percent while the financial, industrial and holding firms gained over 1 percent.

Stock markets across the globe were buoyed by speculation that central banks would use greater monetary stimulus amid a recent string of gloomy data.

Foreign investors, however, continued to pare down their holdings of local equities. There was P660 million in net foreign selling for the day, which suggested that local investors made up for the slack in foreign interest.

Value turnover amounted to P6.17 billion. Market breadth turned positive as there were 104 advancers that edged out 60 decliners while 40 stocks were unchanged.

Megaworld, ALI and JG Summit led the PSEi’s rebound, all rising by over 5 percent. AGI rose by over 3.94 percent.

URC, SM Prime, PLDT and BDO were all up by over 2 percent while Jollibee, MPI and Globe rose by over 1 percent.

Metrobank was also slightly higher.

Outside of PSEi, the notable gainers include FPH (+3.05 percent) and RRHI (1.84 percent).

On the other hand, FGEN and DMCI fell by over 1 percent while GTCAP slipped by 0.81 percent.

Security Bank slipped by 1.32 percent.