PSEi slips ahead of US jobs data

THE LOCAL stock barometer returned to the doldrums on Friday as investors across the region turned cautious ahead of a crucial US jobs data.

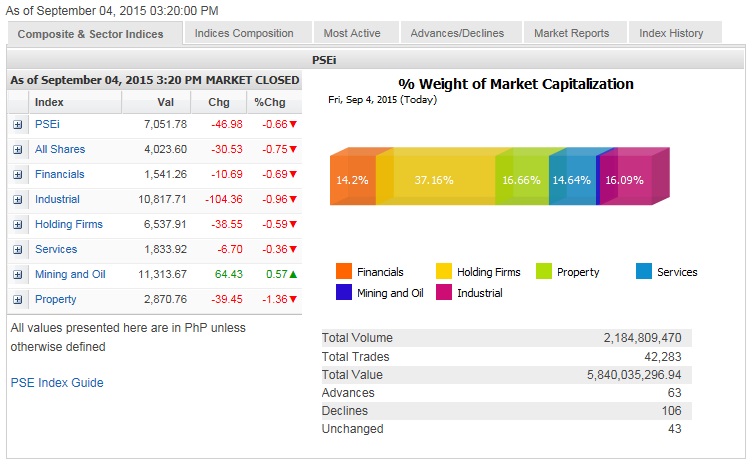

The Philippine Stock Exchange index lost 46.98 points or 0.66 percent to close at 7,051.78, tracking mostly sluggish markets in the region.

Investors are closely monitoring the next U.S. payrolls data from which they expect to find clues on whether the US Federal Reserve would raise its key interest rates this September as widely anticipated before China triggered a global stock market shake-out.

At the local market on Friday, the index was down by around 0.6 percent or 47.03 points for the four-day trading week.

The day’s decline was led by the property counter, which slumped by 1.36 percent while the financial, industrial, holding firm and services counters also ended lower. Only the mining/oil sub-index was marginally higher.

Value turnover amounted to P5.84 billion. There were 63 advancers which were outnumbered by 106 decliners while 43 stocks were unchanged.

Foreign investors continued to be net sellers in the market amounting to P267 million for Friday.

The PSEi was led lower by SM Prime and BDO which both slumped by over 2 percent while URC, SMIC and AC all faltered by over 1 percent.

ALI, Metrobank, GTCAP, Globe, AGI, MPI and Meralco also slipped.

Outside of PSEi stocks, Cebu Air (-2.49 percent) and SBS (-0.38 percent) fell in relatively heavy volume.

On the other hand, the PSEi’s decline was curbed by the 3.37 percent gain eked out by Semirara while PLDT and JG Summit also modestly gained.

Non-PSEi stock DoubleDragon also gained by 0.68 percent in heavy trade.