Banks strive to stay in sweet spot

They oil the wheels of the economy and still control the bulk of the assets of the financial system in this country. But the business of financial intermediation—which in the most simplistic term is to make money out of recycling money—is becoming more and more difficult for bankers in this day and age.

In the Philippines, while cost of funding has gone down with ample liquidity in the financial system, the same has constrained banks’ ability to impose higher margins unless they are willing to reduce the share of top-tier corporations in their loan book. It is a borrowers’ market and it’s more challenging to chase the top-tier corporations because these big ones have a lot of options. They have a wider choice of creditors knocking on their doors and it’s now easier to raise long-term funds by issuing bonds, equity or some other hybrid or fancy instruments.

Regulations are also evolving globally and locally and while this is for their own good—for instance, the imposition of tighter rules on capital adequacy or new safeguards in real estate lending—this tempers profitability in the short run. Also, any increase in capital causes dilution of existing shareholders so investors typically get wary over institutions with a high propensity to issue new shares.

Competition is also getting tougher, with the sector being further liberalized to bring in more foreign players, prompting local players to go down the base of the pyramid, chase small and medium enterprises (SMEs) and consumers where margins are higher but since many are getting into this space, this means also engaging in a price war to capture quality names. It also entails greater administrative costs to go down-market, for instance to reach out to SMEs, as this requires spending more to scale up the branch network.

In the meantime, volatile global financial markets have prompted banks not to lean as much on the treasury business, which has allowed most of the country’s largest banks to post record-high gains in the last few years when major central banks around the world were “dovish” or biased for monetary easing. But now that such cycle is over, earnings from this business has become more volatile. In the first quarter of the year, many of the big names in Philippine banking had a huge windfall from treasury earnings but during the second quarter, there wasn’t the same opportunity.

The good thing is that banks have recognized that the key would be to build a durable source of revenues. Apart from growing their loan portfolio, they now make the most out of their branches by cross-selling related products such as life insurance, mutual funds and other wealth management products. And being a sector that closely reflects growth in the economic cycle, the higher growth trajectory and favorable demographics of the country are seen sustaining a good base for banks to grow their business.

“Banks’ cautious strategy of building a defensive and balanced asset portfolio that will not only withstand unanticipated stress in the funding stream but also alleviate downward pressure of lower trading-related gains buoyed profitability,” the Bangko Sentral ng Pilipinas said in its latest report on the status of the financial system.

Interim results

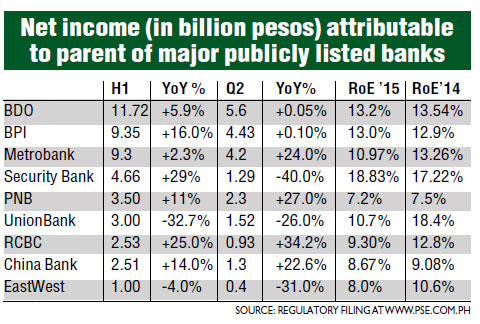

Overall, the second-quarter earnings performance of the country’s largest publicly listed banks were either flat or slower year-on-year. Strong trading gains in the first quarter, however, allowed most of them to post higher six-month profits compared to year-ago levels.

Excluding the impact of extraordinary windfall from securities trading in the first quarter, most banks expanded core businesses and improved the contribution of net interest earnings to overall business in the first semester.

There was a decline in the return on equity (ROE) of most banks in the first semester as trading gains dwindled while net interest margins (NIMs) were flat.

COL Financial head of research April Lee-Tan said that for the second quarter, NIMs turned out flat compared to COL’s earlier expectations of a slight improvement. Early on, there were expectations that local interest rates would bottom out from record-low levels, which would have allowed banks to widen their margins.

In some cases, the decline in ROE was a result of capital build-up. For instance, Metrobank completed in April a P32-billion stock rights offering, resulting in a 23.72-percent growth in the average equity, which outpaced the 2.3-percent improvement in net income, thereby dragging the bank’s ROE. This exercise, however, brought Metrobank’s capital at par with BDO’s at P192 billion and put the bank in a good position to fast-track future growth.

Banco de Oro, benefiting from asset growth that outpaced most peers in recent years, is the country’s most profitable bank in the first half in absolute terms. It made P11.72 billion in six-month net profit, up by 5.9 percent year on year, which translated to 13.2 percent in ROE.

BPI and Metrobank are now at parity in terms of absolute profit at about P9.3 billion each.

BPI grew its net profit in the first semester by 16 percent year on year on a double-digit rise in both interest income and non-interest earnings. In the second quarter, net profit was flat at P4.43 billion as the increase in net interest and other income was offset by higher impairment provisioning and operating expenses.

Metrobank’s six-month net profit improved by 2.5 percent year-on-year to P9.3 billion on higher interest earnings from core lending activities. Excluding one-off items, first half core earnings rose by 30 percent year-on-year, attributed to a double-digit growth in both loans and deposits, stronger contributions from fee based-income and improved efficiencies with better cost management.

Security Bank was the best performer in terms of RoE in the first semester, which at 18.8 percent is the highest among the big boys in banking. In the first semester, net profit rose by 29 percent year-on-year to about P4.66 billion as extraordinary trading gains added to stable earnings from core businesses. The bank is pursuing efforts to grow its retail banking business as a new pillar that would account for about a third of its total business.

PNB posted a double-digit growth year on year in second-quarter and first-semester earnings but these were buoyed by proceeds from asset sale while its RoE of 7.2 percent was the lowest among the country’s biggest publicly listed banks. PNB, which recently merged with affiliate Allied Bank, is still in the process of unloading idle assets.

RCBC grew its first-semester net profit by 25 percent year-on-year to P2.53 billion, driven by the expansion of core lending, deposit-taking and fee-based income. The entry of Taiwan’s Cathay Life as a 20-percent strategic investor is seen to boost the bank’s competitive footing in the years ahead.

Union Bank’s six-month net profit declined by about a third year-on-year to P3.01 billion as the decline in trading gains outpaced the modest growth in net interest earnings.

China Bank grew its net profit in the first semester by 14 percent year-on-year to P2.51 billion as higher loan volume and improved margin boosted interest earnings.

East West Bank’s six-month net profit fell by 4-percent year-on-year to P1 billion due to lower trading gains compared to extraordinary levels last year alongside higher provisions for loan losses. It has embarked on an aggressive branch expansion program and raised P8 billion in fresh capital in May.

Strong backdrop

Alfred Dy, head of research at CLSA, said there were good prospects for Philippine banks which, he said, would likely sustain a loan growth of 15 percent this year and 16 percent in 2016 given the strong macroeconomic backdrop and low leverage. The credit and infrastructure cycles in the country were still at an early stage, Dy said.

As of end-June, outstanding loans of commercial banks—net of placements with the central bank—expanded by 14.5 percent, which was the same growth rate in May. Based on the latest consensus forecasts, Philippine gross domestic product (GDP) will grow by 6 percent this year. Although the consensus forecast has gone down from the earlier forecast of 6.4 percent following the disappointing first-quarter results, this is better than the below 5-percent trend growth rate seen prior to 2010.

Dy said the banking sector’s growth would also be underpinned by a robust GDP growth in a low-inflation rate environment. Historically low interest rates—with current rates easily 400 basis points below where they were years ago–are also seen to stimulate lending activities.

At this point, Dy said Philippine banks were still in an early credit cycle as reflected by the average loan-to-deposit ratio of 64 percent, which he noted was still the lowest among Southeast Asian banks and far below the peak of 95 percent in 1996.

Philippine banks likewise have enough financial muscle to fund the expansion, with core or tier 1 capital adequacy ratio at 15.1 percent, way above the minimum requirement of 8.5 percent (including a 200-basis point buffer) under the Basel 3 capital adequacy framework, Dy said.

Basel 3 framework requires a complex package of reforms designed to improve the ability of banks to absorb losses. It also extends the coverage of financial risks and requires stronger firewalls to protect banks especially during periods of stress.

“At this early stage, banks are already preparing for the additional tier-one capital requirement of 150 to 300 basis points that the central bank will implement on a staggered basis over 2017-2019,” Dy said.

With the Philippine economy acquiring a new engine from investment spending while previously only reliant on consumption, banks are seen playing a big role.

“This is an early-investment-cycle story, given annualized gross fixed-capital formation is only 20.5 percent of nominal GDP,” Dy said. Corporate Philippines, in general, is also seen to have enough leeway to source more funds from banks as leverage was only at 51.3 percent compared to 84.7 percent in 2003, Dy said.

“We expect the ratio of infrastructure spending to GDP to increase from 2 percent currently to 5 percent in the medium term, which will include an acceleration of country’s public-private partnership (PPP) program in infrastructure,” Dy said.

JP Morgan, in a research note on Asean banks dated July 16, said that while net profits had been expected to decline quarter-on-quarter in the the second quarter as earnings normalize from an unusually strong bond trading quarter, the favorable credit environment should underpin robust core income growth.

“The region is entering a credit cycle, save for The Philippines. This is showing up in slower loan growth, higher NPL (non-performing loans) formation, NIM (net interest margin) pressure and tighter credit standards,” JP Morgan said, noting that the Philippines was the only market in the region where it was still upbeat on the banking sector.

JP Morgan is expecting a sequential improvement in return on equity (ROE) of Philippine banks from the second to the fourth quarter of 2015, citing the sector’s improving core income amid prudent cost growth.

CLSA’s Dy also took note of the sector’s strong asset quality, saying that the average NPL ratio of 1.95 percent was lower than the ratio before the Asian financial crisis while the buffer for NPL was more than 100 percent.

“We do not expect a repeat of the 1990s’ NPL blowout anytime soon, given the conservative stances of the banks and the central bank. Property price in Makati and Ortigas CBDs are in real terms still way below pre-Asian financial crisis levels,” Dy said.

Challenges

For BPI Securities, while the Philippine banking system remained healthy, downward pressures are building up in terms of declining net interest margins (NIM), decelerating loan growth and deposit growth and need for higher capitalization of banks to sustain growth in risk-weighted assets. Furthermore, there are increasing regulatory requirements and pressures on profitability from rising competition, BPI Securities said.

Some of the big banks have already increased capitalization either to meet regulatory requirements or to sustain the pace of expansion, BPI Securities said. “However, we believe that banks may revisit their capitalization structure should the opportunity to finance large-scale PPP project be present—a key risk in our view,” BPI Securities said.

JP Morgan said the sector’s leverage could increase over the next few quarters as it is not factored in any equity raising.

In recent months, banking regulators have also moved toward tighter regulations. One circular on real estate, for instance, signified a cautious stance on banks’ exposure to real estate, the brokerage house said. Also, the liberalization of the entry of foreign banks is seen to heat up competition further.

“We expect costs to increase slightly over the next few quarters as banks remain in investment mode. We believe the divergence in cost/assets is a key driver of returns,” JP Morgan said.

Tighter competition and the need to scale up, among others, are seen to trigger a new wave of mergers and acquisitions in the banking system.

CLSA’s Dy said that for the predators in the market, buying banks would be a sound business decision. Among his reasons are:

The Philippines is the 12th-most populous country in the world, with more than 100 million people, 50 percent of whom are under the age of 25, suggesting more demand for banking services in the future

It is easier to buy an existing bank and grow it than to start from scratch, given the time needed to get the necessary permits, location and manpower. It also takes time to build a brand name in the banking space

Per-capita income is moving up and should hit $2,925 this year and $3,102 in 2016 and experience shows that consumer leverage typically kicks in when per-capita income starts to exceed $3,000

Universal banks can engage in business outside of traditional banking, including investment banking, stockbrokerage, leasing and insurance

The valuations of some banks have not gone through the roof yet

“Allowing foreign banks to own 100 percent of the voting stock of an existing bank, up from the previous maximum 60 percent, is a big plus as we understand there are a lot of foreign banks that would like to own 100 percent voting stock outright, as they do not want to deal with minority shareholders,” Dy said.

Striking a balance

Bangko Sentral ng Pilipinas Governor Amando Tetangco Jr. said that while the financial sector provided the lifeblood for economic growth, in reality, the sound macroeconomic picture also supported the development of the financial sector. He said the main challenge facing the financial system would be to ensure that the wheels of the Philippine financial system would continue to run smoothly and that the economy stay in the course of healthy expansion.

“Key to this is striking a balance between encouraging financial innovation, which is critical for economic advancement, and curtailing excessive financial risk-taking. There are no rule books for this, however, for this is both an art and a science,” Tetangco said.