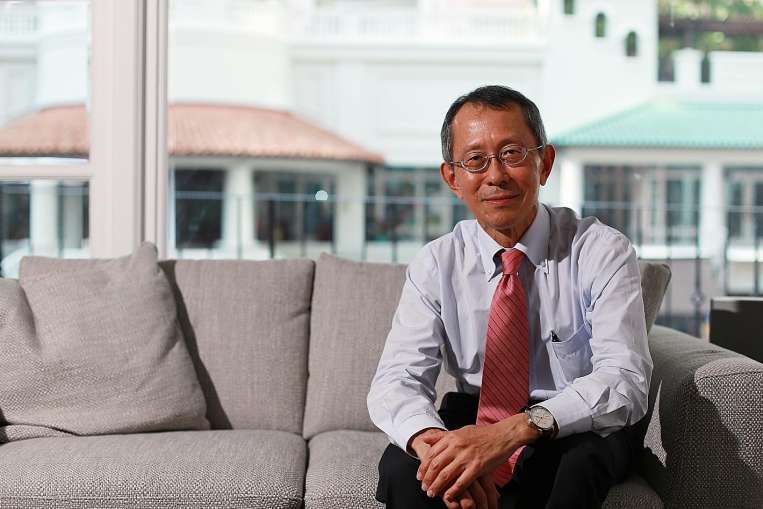

Studying engineering has paid off for investment firm boss Yeo Seng Chong, taking him to places and jobs he never envisaged.

He was an engineer for five years after graduation, before moving to a statutory board for five years, a period that included another left turn – serving as a diplomat in China for four years.

Yeo, 61, later took on senior positions in business development and marketing in large companies for 10 years, before deciding to start fund management firm Yeoman Capital Management in 1999.

There, he applied the same principles he had developed as an engineer to his work as chief investment officer and chief executive.

Yeo, who is married to a housewife, has a 28-year-old daughter, who is an accountant in London, and a 24-year-old son, an undergraduate in New York City.

He reads voraciously across a variety of topics, including military history, the Middle East and archaeology. Reading helps him understand the ebb and flow of human geography and history, he says, so he can grasp the long-term view which gives him “a perspective different from the day trader.”

He believes that a value-based approach to investing is relevant for investors of all ages, even for new investors in their mid-40s, and notes they should proceed with care and prudence. “Move step by step, in a measured way but decisively each time.”

He says “value investing is evergreen if prudently or conservatively implemented and, although it is not easy, it can be done.”

He adds: “Investment success requires dedication, focus, objectivity, intellectual rigor, discipline, continuous learning, a working knowledge of accounting and plain hard work.”

Q What interests you about the industry?

A I work with piles of macro data for the local, regional and world economic environment and micro-economic data for each sector or enterprise under study.

Then I apply fundamental analysis to make valuation assessments for each listed security to appraise its investment merits.

I have to make decisions and take action in the present time that will eventually contribute to future outcome, working from the known to address the unknown.

The work is intellectually stimulating, but it can also be tedious because of the sheer volume of data that I have to handle.

Q Describe your investment philosophy.

A Absolute return, value long-only, with a long holding period – on average five years – with low portfolio turnover.

Q What is in the portfolio?

A We are invested in Hong Kong, South Korea, Malaysia, Singapore and Thailand in descending order of percentage allocation. We hold little or no cash at all times.

We invest in listed equities only – no derivatives, no leverage, no short-selling. The stocks that we own are mainly in manufacturing, technical services, distribution, retail and a few property counters, all in the small-cap segment.

Q What were your best and worst investments? What was the one that got away?

A My best investment is in the fund that I manage: $100,000 invested at the end of October 1997 is $953,000 now (as of end-June), nett of all fees. This implies an annual rate of compounding of 13.6 per cent over the long term.

There have been stocks that went to zero in our portfolio but because of proper risk controls, they did not have any serious impact.

Q What would you say to someone who is starting out and trying to put together a portfolio?

A Take responsibility for yourself, research thoroughly and seek out competent and qualified people with an established track record.

Acting on stock tips from other people does not count as hard work.

Adopt a value approach like what I am doing, focusing on low price-to-earnings, low price-to- book and high dividend yield stocks with a listing history of five years or more.

For an amateur, I suggest you work with 10 stocks for a portfolio size of $100,000 to $1 million for a start. Track your portfolio performance meticulously, accounting for buys, sells, dividend receipts, transaction charges and custody charges to get your “nett of fees” outcome monthly, quarterly and annually.

RELATED STORIES

Focus on what makes a company tick

Fitness buff has his career all worked out