THE LOCAL stock barometer continued to tumble on Tuesday, slipping below 7,500, as the renewed slump in China’s stock markets curbed risk appetite across regional markets.

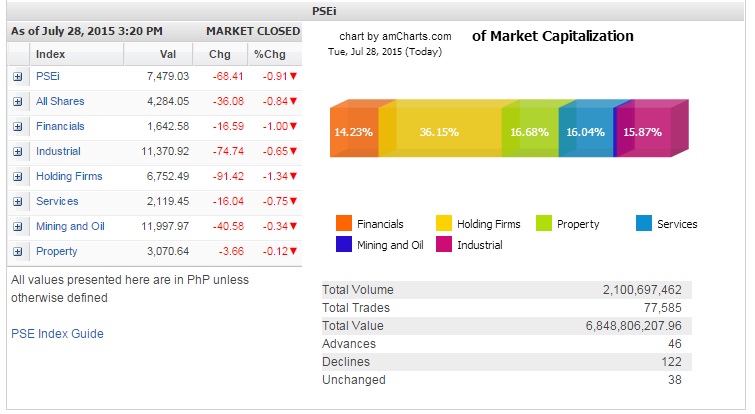

The Philippine Stock Exchange index lost 68.41 points or 0.91 percent to close at 7,479.03, declining for the second consecutive session.

The local market was weighed down by net foreign selling which amounted to P1.27 billion for the day amid sluggish Wall Street and regional trading and in the absence of fresh catalysts from the last State-of-the-Nation-Address of Pres. Aquino.

All counters ended in negative territory but the most battered were the financial and holding firm counters which slid by over 1 percent.

“The market has remained within trading range an continues to lack impetus for a continued rally possibly due to a lack of leads however notably second quarter/first half (corporate results) have started stream in,” said local stock brokerage DA Market Securities.

Value turnover for the day amounted to P6.85 billion. There were 46 advancers which were edged out by 122 decliners while 38 stocks were unchanged.

DMCI and BDO led the PSEi lower, falling by 3.38 percent and 2.86 percent, respectively. DMCI is still reeling from the mining accident at Semirara while BDO’s six-month results were lower than market expectations.

FGEN was also down by 2.4 percent while GTCAP, Metrobank, Globe, SMIC, MPIC and AP all declined by over 1 percent.

Shares of URC, PLDT, JG Summit, ALI, AC, Semirara, ICTSI, Jollibee, Megaworld and Meralco also declined.

Among the few that bucked the day’s downturn was SMPH, which advanced by 1.71 percent.