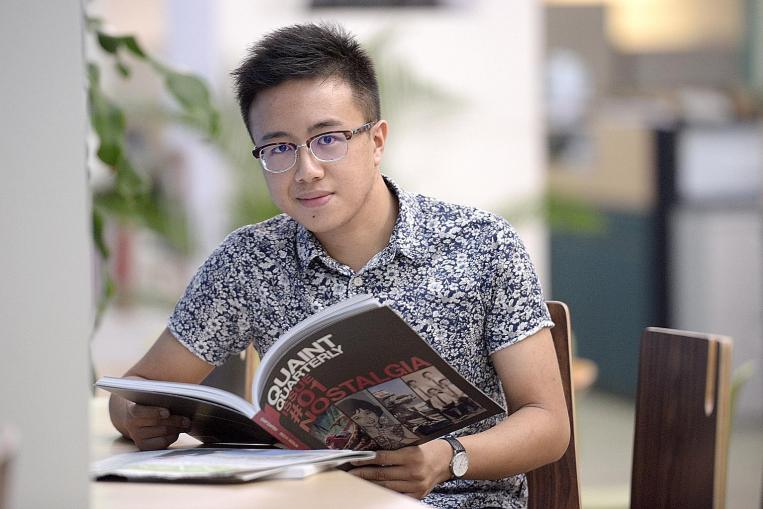

Student Samuel Wong believes in investing early and taking the conservative approach to generate returns over the long run. ST PHOTO/LIM SIN THAI

Armed with ambitious goals and big dreams, young investor Samuel Wong has his life mapped out.

The student hopes to eventually pursue a career in asset management or investment banking.

Finance and investing caught the 20-year-old’s attention in 2009, when he was watching the global financial crisis unfold.

He says: “I was really interested in what was going on in the world, as the economies of countries collapsed one by one. It made me realize the whole economy moves in a cycle, and I asked my father if I could buy a stock through him.”

He held shares in one United States-listed firm for about three years and saw it triple in value as the world economy recovered.

The budding entrepreneur says: “Along the way, I earned extra pocket money by selling DVDs about magic and investing in ornamental fish such as arowanas and stingrays. I accumulated a five-figure sum by the age of 15 and a six-figure sum before 20.”

Wong also decided to attend polytechnic, even though he qualified for most junior colleges, to get a headstart in the world of finance.

That path allowed him to take up stints at Bank of America Merrill Lynch and GIC, which “gave me invaluable insight and first-hand experience of the financial sector.”

He even took Associate Financial Planner certification during his school holidays with his future in mind. “I created a retirement plan with sensitivity analysis to account for different possibilities in life. Although it was not perfect, it showed me the importance of saving.”

Wong has three different parts to his portfolio. He invests mainly in the US stock market, holds some stocks in the Singapore stock market – where he has mostly blue chips – and has alternative investments in fish.

He has assets of about $113,000 now, including stingrays that cost thousands of dollars.

Wong strongly believes in starting early: “With compound interest, what I save now allows me to consume more in the future. It’s like planting seed in the garden. The more seeds you plant means you’ll have a higher probability of harvesting returns in the future.

“That’s why I’m going to slog now and invest my time wisely.”

Describe your investing style.

I’m an extremely conservative investor. The portfolio I have structured aims to generate a return similar to the market index, but with a significantly lower level of volatility. I reduce market exposure by using options.

My goals as a conservative investor are to develop a greater level of patience to observe, digest and analyse for high-probability situations.

What does your portfolio look like?

The bulk of my portfolio consists of US equities and options as they outperform other asset classes over longer periods. As valuations are still fairly high, I am holding around 40 per cent in cash, and am anticipating a correction.

As I would like to pursue a career in the fund management industry, I’ve structured my portfolio to emulate a semi-market neutral hedge fund – with a net market exposure of -10 to 50 per cent, depending on economic conditions.

This market exposure is controlled through using S&P 500 index options as a short position to reduce exposure to the market.

The portfolio that I’ve structured emphasizes absolute returns, low volatility, risk reduction and passive income. The selling of call options is used to create passive income from time decay.

Due to the relatively high volatility in the markets recently, I use dollar-cost averaging over two or three phases, a simple technique to enter and exit my positions to reduce timing risks.

Equities I currently hold are from two categories – value stocks with good fundamentals, such as General Motors and Citibank, with low price-to-earnings ratios, and stocks with competitive moats and good business models, such as Google and Solar City.

Besides looking at fundamentals using ratios, I also select stocks on a thematic approach.

As the population of developed countries ages, I believe sectors such as insurance and healthcare will outperform. I’m relatively bullish on Metlife, Prudential and DaVita Healthcare, a kidney dialysis treatment company.

The returns from my portfolio are about 3 per cent over five months this year. They aren’t fantastic but the volatility is very low and I’m happy with that. Successful investing is a journey, not a one-time event. It’s about the process not the outcome.

What is your best investment?

My hobby, which is tropical fish trading, and investing that I started doing when I was younger.

It exposed me to different kinds of people from all walks of life and honed my interpersonal and communication skills. Give me three minutes and I can sell you a fish.

It also taught me the importance of market analysis of demand and supply in a semi-liquid market.

What is your worst investment?

I like the quote: “Failure is simply an opportunity to begin more intelligently.” Every investment made is a learning opportunity regardless of the outcome.

My worst investment has been Yahoo, down about 14 per cent from my average cost. I sold some call options for time decay to reduce my net exposure for a gain of more than 4 per cent, so my overall loss is about 10 per cent.

The bulk of the loss probably came from an overestimation of tax savings when it spun off its Alibaba stake. Yahoo is currently trading at a great discount from its sum of parts valuation, so I will continue to hold it.