This year is a turning point for the Association of Southeast Asian Nations (Asean) as member-countries form a unified economy, the Asean Economic Community (AEC).

Under AEC 2015 or “One Asean,” the region commits to the free flow not just of merchandise goods but of services, capital and investments.

In line with the AEC objectives, seven bourses in six Asean countries formed in 2011 the Asean Exchanges, a regional collaboration to promote Asean as one asset class. The members are the stock exchanges from Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam’s two bourses.

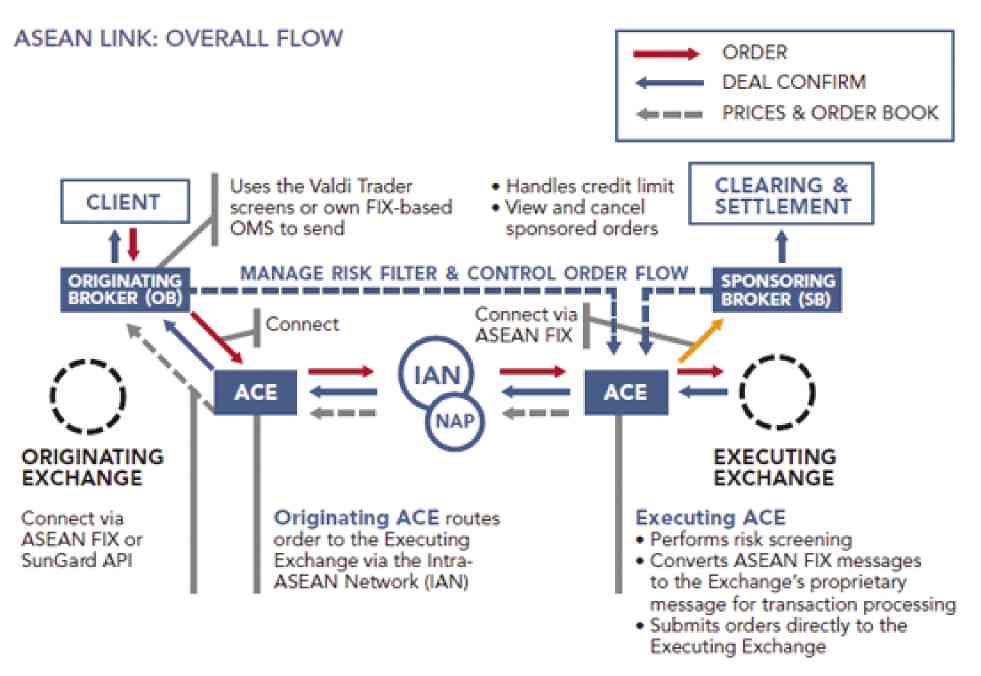

By 2012, this regional collaboration has put in place the Asean Trading Link to connect the bourses, paving the way for what were envisioned to be streamlined, cost-effective post-trade procedures for cross-border transaction conducted through the Asean Trading Link. More than 3,600 companies are listed on these exchanges, including some of the biggest and most dynamic companies in the world, encompassing various sectors such as banking and finance, energy, telecommunications, commodities and manufacturing.

The Asean Link, however, involves only three stock exchanges in the region to date: The Stock Exchange of Thailand, Bursa Malaysia and the Singapore Exchange. The Philippine Stock Exchange, the Indonesia Stock Exchange as well as the two equity markets of Vietnam — Hanoi Stock Exchange and Ho Chi Minh Stock Exchange—have yet to join the trading link.

In the case of the PSE, the local bourse wants to be eventually part of this cross-border link but does not yet find it too compelling to join this regional trading platform at this time.

“I don’t think we have enough product lines to benefit from it. We don’t have as much listed companies. If we join too soon, instead of creating inflows, we may even create outflows,” said one PSE board member.

The forthcoming consolidation of the PSE and the Philippine Dealing System Group is seen strengthening the capital market infrastructure.

But even assuming the PSE feels it is now ready to join the Southeast Asian trading link, it cannot join yet because the local corporate regulator, the Securities and Exchange Commission, is not yet a member of the International Organization of Securities Commissions (IOSCO), an association of organizations that regulate the world’s securities and futures markets. The regional trading link requires that the SEC be part of a mutual recognition scheme that would render as valid the onshore trades of foreign securities and vice versa. After all, harmonizing rules with regional peers is a prerequisite.

But getting into IOSCO is no walk in the park. The SEC has to go through a rigorous process. The primary objective of IOSCO is the exchange of information but the Philippines is one of the countries with stiff bank secrecy laws.

SEC Chair Teresita Herbosa is hopeful that the SEC will find a gateway to IOSCO soon. “We’re rewriting our application,” she said, noting that representatives from the international organization are visiting this mid-July to interview people.

“Once they make the new report based on their ocular inspection, the next feedback will probably be by September,” Herbosa said.

The moment the SEC gets into IOSCO, Herbosa said, the PSE would be able to join the trading link. But assuming that it still could not get into this association, Herbosa said there was plan “B.” “We can ask for a relaxation of requirements so we can join the Asean link,” she said.

Meanwhile, further investor education is also key to making the Asean Link a success. After all, how can local investors trade equities they are not familiar with?

Each member of Asean Exchanges is thus tasked to embark on its own engaging activities with local market players to market and create greater visibility of Asean products.

The goal is to bring more Asean investment opportunities to more people as well as enhance liquidity among members of the collaboration. Another key regional initiative thus includes the promotion of “Asean Stars”—the 180 Asean blue-chip stocks which represent the 30 “most exciting” companies of each Asean country as ranked by investability in terms of market capitalization and liquidity.

The “Invest Asean” retail roadshows, on the other hand, seek to profile the exciting companies listed on the seven exchanges in Asean to mainly retail investors.

Through the Asean Exchanges website www.aseanexchanges.org, investors can access aggregated Asean market data and analytics, market performance of the seven Asean exchanges individually, broker research reports and FTSE/Asean indices weekly report. The website is built around these “Asean Stars.”

By driving cross-border collaboration, streamlining access to Asean, creating Asean-centric products and implementing targeted promotional initiatives, the regional collaboration intends to make Asean capital market stronger and promote Asean as one compelling asset class.