It is no secret: The Philippines has one of the weakest infrastructure ecosystems among the six largest economies in the region.

According to the World Economic Forum’s Global Competitiveness Report published last year, the Philippines ranked 98 out of 144 countries in terms of infrastructure, way behind Singapore, the most advanced country in the Association of Southeast Asian Nations (Asean), which ranked 5th globally.

Other Asean nations which ranked ahead of the Philippines in the report were Malaysia (25th globally), Thailand (61st) and Indonesia (82nd).

Among the 10-member countries of the economic-political bloc, the Philippines came ahead of Vietnam which was ranked 110th globally.

Broken down into specific sectors, the picture looks even bleaker.

According to WEF, the Philippines ranked 81st globally in terms of mobile phone connectivity; 87th in quality of roads; 89th in quality of railroad infrastructure; 93rd in quality of electricity supply; 109th in fixed telephone connectivity; 113th in air infrastructure, and 116th in port infrastructure.

But more than the just numbers, the weak infrastructure of the country has growing real-world effects on this nation of almost 100 million people.

“Going beyond the statistical comparisons, the infrastructure deficiencies translate to real costs to the economy in terms of productivity and efficiency and to ordinary citizens in terms of travel time, congestion, pollution and poor access to basic utilities,” said KPMG Philippines vice chair Emmanuel Bonoan in a report published by the audit and consultancy firm recently.

“For public transport, commuters anecdotally report a commute of three to four hours every day, requiring several transfers from tricycle, minivans, rail and bus from the suburbs to Makati, Metro Manila’s main business district,” he added. “Bloomberg quoted a jeepney driver who has been driving for 20 years who said that a 15-kilometer route which used to take 30 to 40 minutes now takes two hours, cutting down his turnaround time and daily income.”

The Aquino administration has come under intense criticism from the public for failing to address these infrastructure weaknesses during its time in office, but to some degree, the criticism is unwarranted.

Lost beneath the noise are genuine efforts by policymakers to accelerate developments in this sector, not least of which is the smoothening out of kinks in the government’s Public-Private Partnership (PPP) scheme which, it is hoped, will pave the way for faster implementation of much needed projects.

According to stock brokerage and investment bank Macquarie Securities, infrastructure spending will rise strongly in the last few months of President Aquino’s term, noting that a final push is in the offing to help long-delayed projects move from the planning stage to the implementation.

In addition, the government has financial resources at its disposal to give these projects a boost ahead of the end of Aquino’s term in 2016.

“The main challenge for the government will be to spend the fiscal ‘savings’ from procurement reform, as well as the extra revenue from better customs procedures,” it said in a recent study. “This year’s priority for the government is to boost the disbursement of government funds to 90 percent of appropriations (from about 80 percent last year).”

“With the revenue constraints largely removed, we expect stronger government spending [particularly on infrastructure], to complement private infrastructure spending through the Philippines’ robust PPP framework,” Macquarie added. “Stronger infrastructure investment will contribute to the acceleration of real gross domestic product growth to 7.4 percent in 2015, with private investment (including foreign direct investments) growing 9.3 percent.”

Indeed, invigorated government efforts have seen 10 PPP projects awarded to date. These are the Daang Hari-SLEx Link Road project; the PPP for School Infrastructure project (phases 1 and 2); the Naia Expressway Project; the modernization of the Philippine Orthopedic Center; the Automatic Fare Collection System; the Mactan-Cebu International Airport Passenger Terminal Building; the LRT Line 1 Cavite extension and operation and maintenance deal; the Southwest Integrated Transport System project; and most recently the Cavite-Laguna Expressway project.

These 10 projects have a cumulative value of almost P200 billion.

The companies involved in these deals, all of them listed on the bourse, stand to gain significant upsides on their investments, barring any delays and contract revisions.

Among the listed conglomerates involved in the infrastructure scene, the Ayala group is one of the most focused, thanks to a subsidiary which takes care of all its activities in this sector. Called AC Infrastructure Holdings Corp., the firm is tasked with “selectively pursuing toll road, rail and airport projects under government’s public-private partnership program.”

Its president, Eric Francia, revealed recently that the conglomerate had budgeted $1 billion over the next five years for the group’s investments in energy and infrastructure.

Another aggressive player in the infrastructure game is San Miguel Corp. which bagged earlier the Naia Expressway deal and is constructing the quasi-PPP Skyway Stage 3 project that will link the South Luzon Expressway to the North Luzon Expressway.

San Miguel president Ramon Ang had vowed early on to “join every bidding process” for government projects in order to boost competition and help the government raise more funds. And he has kept his word, joining most auctions and pushing up government’s yields on each deal bid out.

Also active in the PPP scene is Cebu-based Aboitiz Equity Ventures which had earlier participated in the bidding for the Mactan Cebu International Airport passenger terminal, which was eventually won by another listed firm, Megawide Corp.

Megawide, while having flown below the radar in recent years, has bagged the most number of PPP infrastructure deals awarded by the Aquino administration. The most recent one was the Southwest Integrated Transport System project, joining the company’s earlier wins like phases one and two of the School Infrastructure Project and the rehabilitation of the Philippine Orthopedic Center.

Finally, there is the SM group which, for the most part, has shied away from government PPP deals, but is participating for the first time—in a big way —in the biggest infrastructure deal that is yet to come.

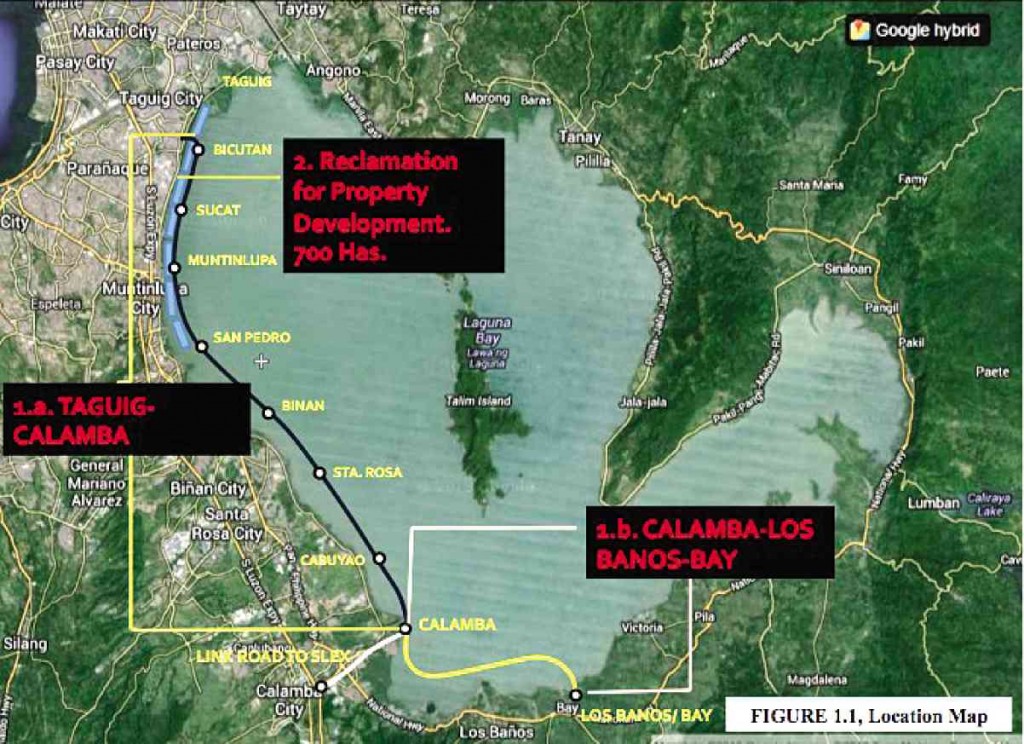

The government is preparing to bid out the P122.8-billion Laguna Lakeshore Expressway Dike project, which is a 47-kilometer tollroad to be built on top of a dike meant to prevent flooding in low lying areas around Laguna Lake. More importantly, the project will also have a land reclamation component of 700 hectares, given prospective bidders tremendous upside in terms of real estate values.

Three groups have prequalified, the largest of which is the Team Trident consortium of Aboitiz Equity Ventures, Ayala Land Inc., Megaworld Corp. and SM Prime Holdings. Also prequalified were San Miguel Corp. and the Alloy-Pavi Hanshin LLED consortium composed of Malaysia’s MTD Group, the Villar group and Korea’s Hanshin Construction Corp.

This project is likely to be the last big-ticket item to be bid out by the Aquino administration.

Most of these infrastructure projects will come to fruition years after Aquino steps down from office. Thus, his legacy will not be a string of completed infrastructure projects as originally envisioned, but a series of deals that will generate jobs and fuel the Philippine economy for the duration of their construction periods.

It’s not ideal. But it’s not bad either.