Unleashing Asean’s potential in e-commerce

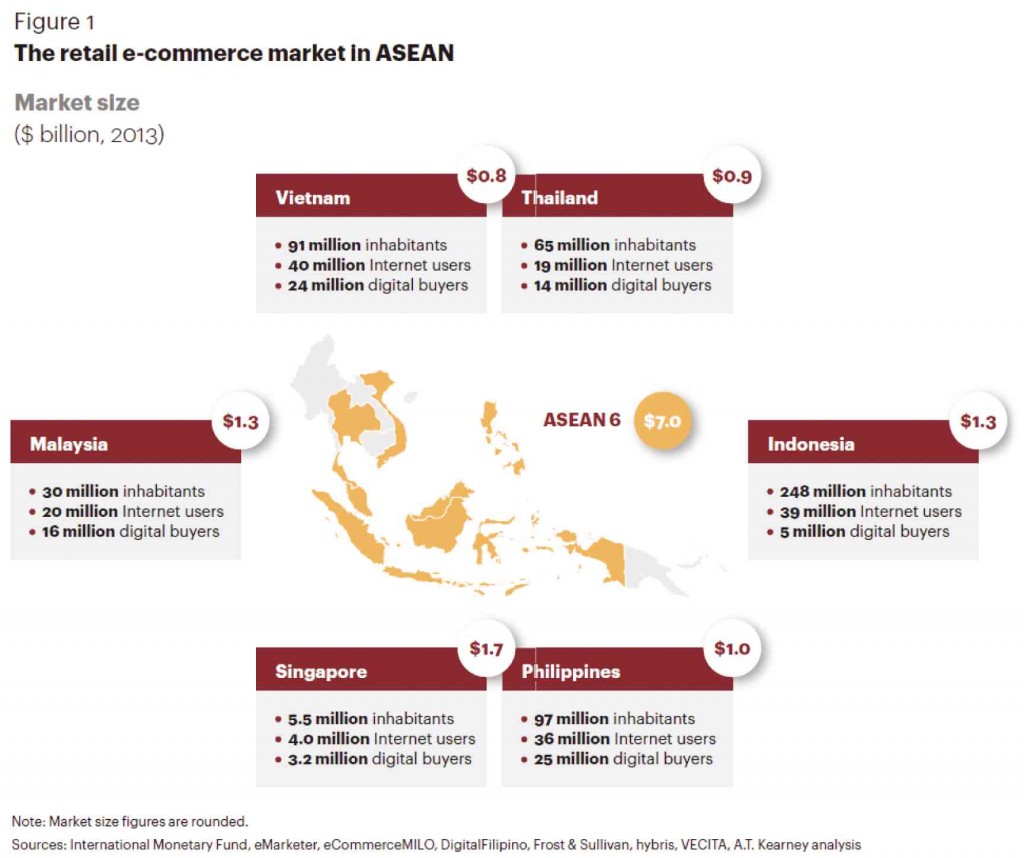

The online retail market in Asean 6 (Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam) has the potential to grow 25 percent a year through 2017, according to the study “Lifting the Barriers to E-Commerce in Asean,” released recently by management consulting firm, A.T. Kearney.

Globally, only China is expected to experience similar growth rates in online retail.

“Asean 6 accounts for less than 1 percent of global online retail, even though it has 3 to 4 percent of global GDP and around 8 percent of the population,” said Geir Olsen, head of A.T. Kearney’s Consumer Industries and Retail Practice in Asia-Pacific and co-author of the study. “We see considerable growth potential for the Asean e-commerce market, but only if it overcomes five significant barriers that stand in its way.”

The firm believes that there are distinct actions the region can take to surmount each barrier and pave the way for sustained growth:

- Increase broadband access

Online users account for just 29 percent of the Asean 6 population, compared to 46 percent in China and more than 90 percent in Japan. In Vietnam, the Philippines, Thailand, and Indonesia, about or less than half of the population uses the Internet; only Singapore’s access to fixed broadband compares to markets such as the United States.

Article continues after this advertisement“Even though mobile broadband is quickly spreading, limited fixed broadband connectivity is an issue, largely due to its continued unaffordability in many Asean 6 countries,” said Soon Ghee Chua, managing director of A.T. Kearney’s Southeast Asia Unit and co-author of the study. “State aid will be essential for improving the region’s access, especially in remote and poorer areas.”

Article continues after this advertisement- Support local offers

Although a few local champions have emerged, consumers appear to be more attracted to offers from foreign players that do not necessarily have a local footprint. In Singapore, for example, almost half of the e-commerce market is made up of online players located outside Asean. “In order to encourage local companies to participate in the online-trend, access to finance needs to be improved, the integration of digital talent needs to be fostered and the awareness of e-commerce marketplaces needs to be promoted”, said Olivier Gergele, Principal with A.T. Kearney’s Consumer Industries and Retail Practice.

- Reinforce online security

Online shoppers in Asean 6 countries, other than Singapore, are more reluctant to give their credit card information than other online shoppers are worldwide, on average. Asean countries have developed and enforced numerous security laws, including general regulations on e-commerce data protection and electronic transactions, but there are gaps.

“The region would benefit greatly from shared cybersecurity and regulatory best practices and coordinated legislative frameworks,” Gergele said. “Creating an online dispute resolution facility would help the region as well.”

- Promote e-payment

The vast majority of payments for online retail are still made offline, with methods such as cash-on-delivery. The cumbersome “know your customer” processes that e-retailers contend with to comply with anti-money laundering regulations for cross-border transactions hinder the growth of e-commerce. Asean governments can overcome this barrier by promoting non-cash transactions and instituting e-payment regulations that are coordinated region-wide.

- Improve logistics and trade efficiency

Logistics and trade often do not match online shoppers’ expectations in the region. A relatively small share of Asean online shoppers received free delivery in the previous year, indicating that logistics costs are too high for many players, which end up passing the costs on to consumers. Asean geography poses inherent logistical challenges. For example, the remote islands of Indonesia and the Philippines make it particularly hard to deliver products.

The benefits of e-commerce development, however, go beyond direct economic impact. “Retail e-commerce can be a vehicle for economic development, social cohesion, and cultural exchanges contributing to regional integration,” Olsen said.