Metro Manila property sector still attractive to investors

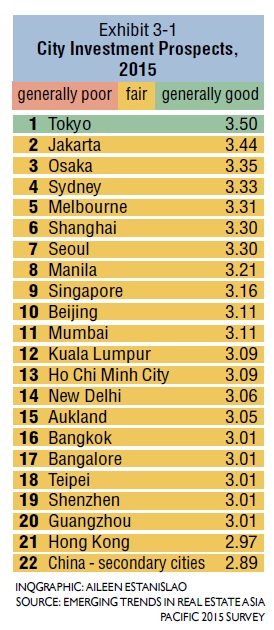

This was based on Urban Land Institute (ULI) and PriceWaterhouseCoopers’ latest annual research “Emerging Trends in Real Estate Asia Pacific 2015,” which ranked the Philippines’ capital regional eighth highest in terms of city investment prospects and likewise eighth in terms of development prospects for this year. There were 22 markets monitored in the ninth annual survey.

Metro Manila’s ranking in the latest survey slipped from fourth place last year in terms of investment prospects but still stood better than other major Southeast Asian cities such as Singapore, Kuala Lumpur, Ho Chi Minh and Bangkok. In terms of development prospects, its ranking was unchanged from last year.

In particular, the Philippines was noted to be still among the “best bets” in the residential property segment alongside its Southeast Asian peers.

John Fitzgerald, chief executive of ULI Asia-Pacific, said in a forum last week that while foreign estate investors had been looking at emerging market opportunities for the last three years, in practice they found limited scope to buy.

The three main risks that stood out this 2015, Fitzgerald said, included an economic hard landing in China, which could have a “knock-on” impact across the region, uncertainties on “Abenomics” or Japan’s economic stimulus program and the looming interest rate increases by the US Federal Reserve.

“Fast-growing emerging markets like the Philippines and Indonesia remained on investors’ radar, but the attraction has dimmed somewhat this year as investors become cautious over the potential for capital outflows in the wake of upcoming US interest rate hikes,” the report said.

Rankings

Ranked higher than 8th-placer Metro Manila in terms of city investment prospects in the ULI-PwC survey were: Tokyo (1st); Jakarta (2nd); Osaka (3rd); Sydney (4th); Melbourne (5th); Shanghai (6th) and Seoul (7th). On the other hand, Metro Manila edged out Singapore (9th), Beijing (10th), Mumbai (11th), Kuala Lumpur (12th), Ho Chi Minh (13th), New Delhi (14th), Auckland (15th), Bangkok (16th), Bangalore (17th), Taipei (18th), Shenzhen (19th), Guangzhou (20th), Hong Kong (21st) and China’s secondary cities (22th).

The research noted that Tokyo would likely continue to be a big draw for real estate investors for as long as Japan continued its economic stimulus program. Tokyo’s attraction is also underpinned by low levels of perceived risk, together with returns that compare favorably with those seen in other parts of Asia.

“Strong economic growth and ongoing investment in the offshoring sector—both business process outsourcing and financial back office—continue to underpin Manila’s popularity, although its fall from fourth to eighth probably reflects investors’ wariness of the possibility of capital outflows in the wake of impending interest rate rises in the United States,” the research noted.

It said that while the Philippines was no longer the “sick man of Asia,” it was “by no means an easy market for foreigners to target.”

Fitzgerald noted that there was no shortage of local capital, therefore constraining demand for private equity investors. Likewise cited were regulations that restrict foreign ownership of land alongside remaining concerns about transparency, bureaucratic conduct and infrastructure bottlenecks.

He also noted that failure to get the real estate investment trust (REIT) industry off the ground was curbing the attractiveness of the market for institutional investors.

REIT allows investors to invest directly in the finished product with existing cash flow–such as residential and office units, hotels or shopping malls or even infrastructure ventures like toll roads and power plants, in turn allowing the property developer to recycle the money to new projects.

Bright prospects

“Still, economic prospects moving forward appear to be strong and should the next government [due in 2016] improve the regulatory environment for foreigners, there could be more opportunities for international money in the future,” the research said.

ULI Philippines chair Carlos Rufino, president of The Net Group, noted that the Philippines has gone a long way since ULI—a global nonprofit research and education organization promoting responsible use of land and creation of sustainable communities—first published its historical investment prospect rankings nine years ago.

Metro Manila used to rank at the bottom of the heap—18th to 20th in investment prospects—from 2007 to 2012 before considerably moving up the scale in 2013 when it rose to 12th place and further to 4th place in 2014.

The ULI survey showed that Asia’s residential market had plummeted in popularity due to concerns that lofty prices might be unsustainable, especially with interest rates in the US on the rise for the first time in more than five years alongside tightening regulations in individual markets.

“Two types of markets remain in favor—those in Japan and those in emerging markets of Southeast Asia, in particular Indonesia and the Philippines,” the research noted.

In Southeast Asia, the ULI research said the residential market was buoyed by “young demographic, booming economies and rapidly rising middle class whose members will be buyers of residential property simply because they can now afford it.”