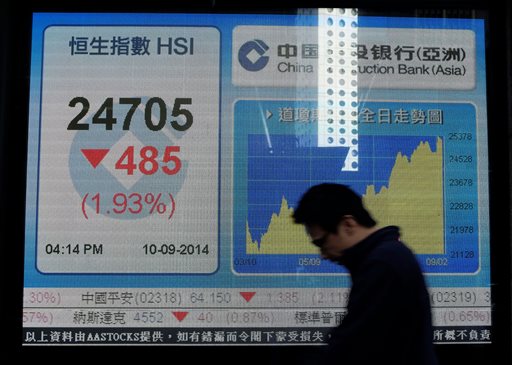

A man walks past an electronic board of a local bank showing the Hong Kong share index in Hong Kong on Sept. 10, 2014. Asian markets retreated Monday, Sept. 15m, after data at the weekend showed Chinese industrial output expanded in August at its slowest rate since the global financial crisis. AP PHOTO/VINCENT YU

HONG KONG–Asian markets retreated Monday after data at the weekend showed Chinese industrial output expanded in August at its slowest rate since the global financial crisis.

Wall Street provided a negative lead after another round of solid indicators fanned expectations the Federal Reserve will hike interest rates sooner than later.

The pound edged lower as investors grew jittery about Thursday’s knife-edge Scottish independence referendum, which could see the country break away from the United Kingdom.

Sydney, where several listed companies rely on Chinese business, tumbled 1.04 percent, or 57.6 points, to 5,473.5 and Seoul closed 0.30 percent lower, giving up 6.04 points to 2,035.82, while Hong Kong fell 0.97 percent, or 238.33 points, to 24,356.99.

However, Shanghai ended 0.31 percent higher, adding 7.19 points to 2,339.14 on hopes the weak data will spur the government to unveil fresh easing measures.

Tokyo was closed for a public holiday.

Beijing said Saturday that industrial production grew 6.9 percent last month, its weakest rate since December 2008.

The key indicator slumped from 9.0 percent growth in July and was also well short of the 8.7 percent median increase expected in a survey of 15 economists by The Wall Street Journal.

The figures add to worries about the world’s No. 2 economy–a key driver of global commerce–following recent indicators suggesting growth is weakening even after limited stimulus measures.

“The (government’s) 7.5 percent (economic) growth target for 2014 is now clearly challenged,” Royal Bank of Scotland said, according to Dow Jones Newswires.

In foreign exchange markets the dollar consolidated its recent gains against the yen after solid reports on US retail sales and consumer confidence added to expectations the Fed will tighten monetary policy as the economy picks up.

However, on Wall Street Friday the Dow slipped 0.36 percent, the S&P 500 fell 0.60 percent and the Nasdaq eased 0.53 percent. The central bank holds its next policy meeting this week.

Pound down, eyes on Scotland vote

In afternoon Singapore trade, the dollar was at 107.33 yen, from 107.31 yen in New York Friday and at levels not seen since September 2008.

The euro fetched $1.2930, against $1.2964 Friday, while it was also at 138.80 yen, compared with 139.18 yen.

The pound bought $1.6252, down from $1.6264 after conflicting opinion polls showed the “Yes” and “No” campaigns in front days before Thursday’s referendum.

There are fears about the likely effects of Scottish independence on the British economy and the uncertainty that would cause, including to pension funds and the debt market.

Stephen Walters, chief economist at JP Morgan, Australia, said: “Uncertainty will be with us for the next couple of years as the terms of the separation are negotiated.”

He added that it was still unclear how separation would be carried out, including the monetary regime, the division of assets and liabilities, and Scotland’s EU membership.

“Should it pass, uncertainty would depress growth in the UK for a number of quarters, delay the beginning of monetary policy normalization, and depress asset prices including the currency,” he added.

Oil prices sank. US benchmark West Texas Intermediate for October delivery eased 74 cents to $91.53, while Brent crude for October rose 39 cents to $97.50 in afternoon trade.

Gold was at $1,234.92 an ounce, against $1,237.10 late Friday.

In other markets:

— Mumbai retreated 0.90 percent, or 244.48 points, to end at 26,816.56 points.

Yes Bank fell 4.99 percent to 601.30 rupees, while Future Retail gained 8.16 percent to 127.25 rupees.

— Bangkok fell 0.14 percent, or 2.24 points, to 1,579.12.

Telecoms company Total Access Communication dropped 2.86 percent to 102 baht, while Airports of Thailand lost 1.24 percent to 238 baht.

— Kuala Lumpur’s main index lost 8.34 points, or 0.45 percent, to 1,847.30.

Malayan Banking fell 0.8 percent to 9.92 ringgit, while utility Tenaga Nasional shed 0.6 percent to 12.40.

— Jakarta closed up 0.02 percent, or 1.19 points, at 5,144.90.

Carmaker Astra International gained 1.04 percent to 7,300 rupiah, while state miner Aneka Tambang lost 0.44 percent at 1,135 rupiah.

— Singapore closed down 0.99 percent, or 33.08 points, to 3,312.47.

DBS Bank eased 1.30 percent to Sg$18.28 while Singapore Telecommunications fell 1.03 percent to Sg$3.86.

— Taipei was flat, edging down 5.72 points to 9,217.46.

Taiwan Semiconductor Manufacturing Co. rose 0.41 percent to Tw$123.5 while Chunghwa Telecom fell 0.54 percent to Tw$91.6.

— Wellington slipped 0.25 percent, or 13.11 points, to 5,210.86.

Fletcher Building was down 1.23 percent at NZ$8.86 while Spark was up 1.83 percent at NZ$3.06.

— Manila closed 0.56 percent lower, giving up 40.61 points to 7,161.27.

Universal Robina fell 0.28 percent to 175.50 pesos and Metropolitan Bank and Trust added 0.17 percent to 88 pesos.