MANILA—The local stock index slipped on Friday but stayed above the 7,200 mark as profit-taking prevailed for a fourth straight session.

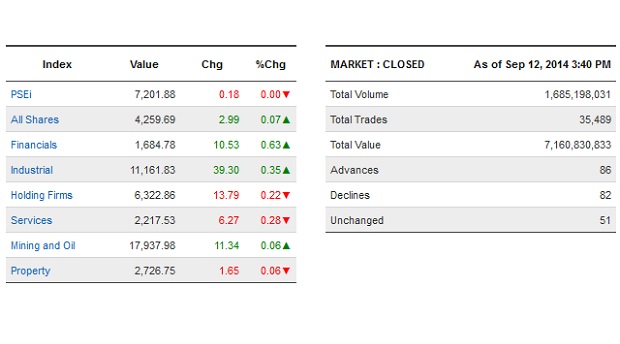

The Philippine Stock Exchange index slipped by 0.18 percent or 0.002 percent to close at 7,201.88. For the week, the index was down by 61.7 points or 0.85 percent, tracking the downturn in most regional markets.

Trading sentiment was mixed as many investors were increasingly cautious of stock valuations. On the other hand, the market has already priced in the Bangko Sentral ng Pilipinas’ decision on Thursday to raise both overnight borrowing and special deposit account rates by 25 basis points.

The holding firms, services and property sub-indices ended lower while the financial, industrial and mining/oil counters held on to modest gains.

Turnover for the day amounted to P7.16 billion.

Despite the PSEi’s decline, there were slightly more advancers (86) than decliners (82) while 51 stocks were unchanged.

The PSEi was led lower by Philex, which slid by 3.85 percent ahead of its exit from the main stock barometer by Sept. 15. Emperador will in turn debut on the PSEi.

The market was also weighed down by large-cap stocks PLDT, ALI, AGI and Megaworld which all fell by over 1 percent.

On the other hand, the day’s decline was tempered by the gains eked out by Jollibee and SM Prime which both rose by over 2 percent. BPI (+1.4 percent) also contributed to the day’s gains.

BDO, URC, AC, AP, Metrobank, ICTSI and Petron also firmed up.

Outside of PSEi stocks, one notable gainer was D&L (+3.44 percent) while Puregold recouped 1.21 percent.