PSEi goes up ahead of US Fed Reserve announcement of new monetary policy

MANILA, Philippines—The local stock barometer gained on Wednesday ahead of a much awaited US Federal Reserve update on monetary policy and on the first trading day after the 2014 State of the Nation Address delivered by President Benigno Aquino.

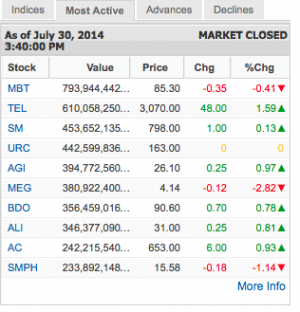

The Philippine Stock Exchange index added 17.12 points or 0.25 percent to close at 6,867.59. Across the region, many markets were up ahead of the release of the latest update by the US central bank on monetary policy.

The day’s gains were led by the financial, holding firm and services counters, which made up for the sluggish trading on industrial, holding firm and services counters.

Value turnover for the day amounted to P8.25 billion.

Despite the PSEi decline, market breadth was negative as there were only 75 advancers versus 106 decliners while 46 stocks were unchanged.

The PSEi gains were led by PLDT (+1.59 percent) while SMIC, AGI, BDO, ALI, AC, GTCAP and MPI also contributed to the upswing.

Outside of the main index, RCBC (+1.91 percent) and Nickel Asia (+1.11 percent) were among the notable gainers. RCBC disclosed on Wednesday a plan to raise P4.5 billion from the sale of new shares to existing investors.

On the other hand, the PSEi’s gains were tempered by the decline of Megaworld (-2.82 percent), DMCI (-1.72 percent) and SM Prime (-1.14 percent). EDC, Philex and AP also declined.