Men in Asia, including Filipinos, are more conscious than ever about their looks—and it’s not just because they want to please the opposite sex.

This was one of the main findings of the “Men Revolution 2013” study of research firm Kantar Worldpanel. It helped explain the robust growth in the sale of grooming products developed especially for men in key Asian markets, outpacing the rate of increase in the female category.

The study was based on the survey conducted in September 2013 of about 5,300 men in eight markets: China, Korea, Vietnam, Taiwan, Indonesia, Malaysia, Thailand and the Philippines. It revealed a 9-percent sales growth in the “for men” grooming products sector as of the end of the third quarter of 2013 from the first nine months of 2012, compared to just 6 percent for the total personal care segment.

Three of five Asian men also said that they disagreed with the notion that using grooming products was a “women thing.”

According to Luz Barra, Kantar Worldpanel commercial director, the findings of the Men Revolution 2013 study show that “marketers need to pay attention to what men need,” and not just what women want.

“By addressing the ‘white spaces’ within the men’s grooming essentials, marketers can grow their brands further,” Barra tells BusinessFriday.

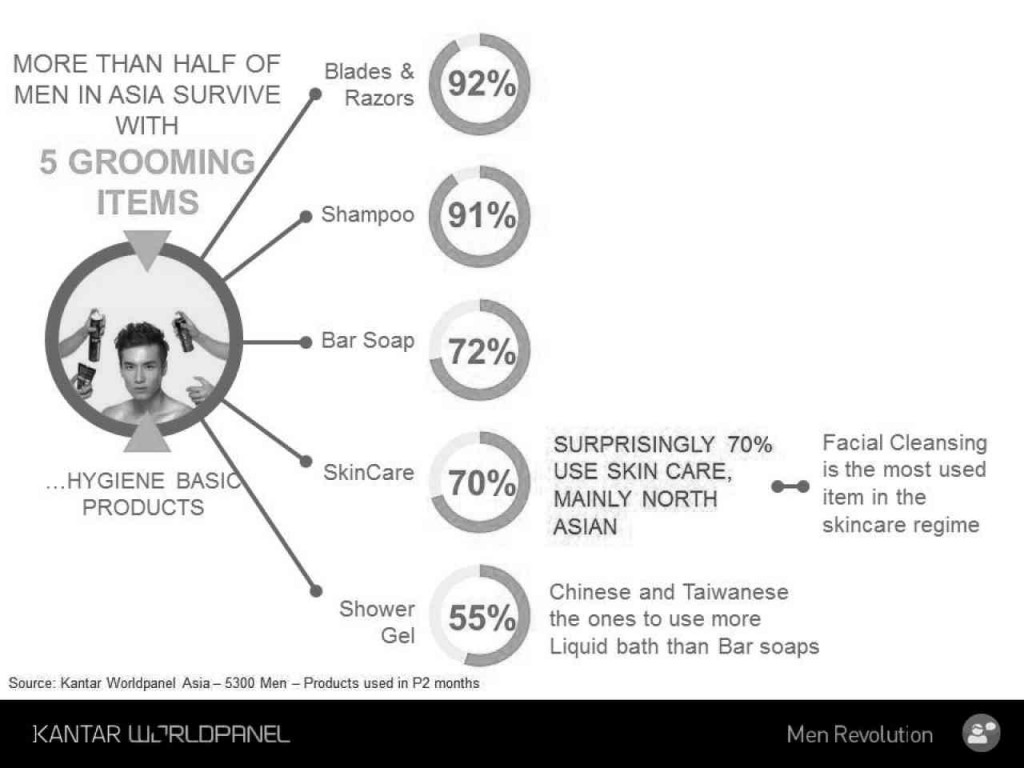

The study indicated that, across the region, the leading products bought by Asian men are blades and razors, shampoo, bar soap, skincare and shower gels.

Filipino men, on the other hand, have different priorities. Bar soap was the most used grooming item, followed by shampoo, blades/razors, deodorants and colognes.

The study also says that, of the eight countries in the survey, the Philippines recorded the highest penetration of bar soap, deodorant and fragrances/colognes—an indication of hygiene practices of Filipinos.

The study also showed that almost all Asian men tended to complain about at least one thing concerning their appearance. For Filipino men, about half are afflicted by acne, and at least 38 percent complain about bad breath.

This presents a golden sales opportunity for manufacturers of anti-acne products.

“What we found in the Men Revolution study is that anti-acne products are not yet part of Filipino men’s grooming essentials. This is a big opportunity for brands to take advantage of in the local market,” says Barra in a statement.

As to the factors that drove men to look and smell good, the study revealed that 84 percent of the men surveyed said they bought grooming products to “feel better” and be “more comfortable.”

Some 67 percent, meanwhile, said that how they looked reflected their social status. Only 64 percent said that they took care of themselves to please women.

On the purchasing habits of Asian men, the Kantar Worldpanel study noted that over half of Asian men considered imported brands of grooming products to be of “high quality.”

Most respondents took note of messages in stores, but 60 percent of men said that usually they would be in a rush when they visited the stores. Most would be willing to wait a while to see if the products they bought would actually work.

Barra hopes that the findings in the “Men Revolution” study will help manufacturing and distribution companies, as well as brand and marketing experts, serve the male market better. While accounting for a mere 2 percent of the total personal care category, the market is growing and men are now more willing to spend on good grooming.

“The results of the Men Revolution study aim to provide brands with relevant information to be able to explore, penetrate and grow the market,” says Barra.

“In this case, personal care brands are given the opportunity to craft and reinvent their strategies to tap not only women but also men, who have become more particular with the products they use and are now, more than ever, aware and conscious of their grooming habits,” she adds.