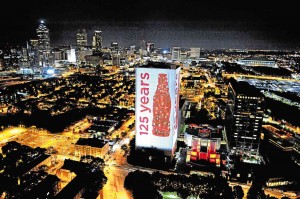

ATLANTA, Georgia—Changes are afoot and they will make the past 10 years seem tranquil compared to the next 10 years, says Muhtar Kent, chair of the board and CEO of The Coca-Cola Company, as he opened a global media briefing in Atlanta, USA, where the fizzy drink was first served 125 years ago.

In the Philippines, as in other markets, choice is becoming double edged sword. With a huge and still growing, tech-savvy youth population willing to try anything new and anything tweeted or “Facebooked” by peers, even a giant like Coca-Cola has to fight off an ever growing number of competing brands.

John M. Farrell, VP and chief strategy officer of The Coca-Cola Co., says, “The real artform in leading a business of this scale is to take advantage of economics but keep it local.”

Flexing its huge distribution muscles, Coca-Cola is building on distribution, building on coolers, and further ensuring that consumers have easy access to its products.

“And we are making sure there is a broad enough set of packages that everyone can afford,” Farrell says.

Farrell says a market with a huge youth base like the Philippines is a “dynamic place” and presents a “bright opportunity” for Coke.

Large chunks of new audiences will in fact be in markets where Coca-Cola has the most potential for growth, Farrell says.

Double in 10 years

Coca-Cola aims to double its system revenue and number of servings by 2020. Presently, it makes 1.7 billion servings per day.

While the global average number of Coca-Cola-manufactured soft drinks consumed by each person per year is 89, this varies widely from market to market.

But more than just opening a Coke bottle or can and calling it “the real thing,” executives know there are more complex tasks ahead.

Kent, in his presentation, describes a very volatile world. One with massive urbanization, the shifting balance of economic power to emerging markets; the rise of a sophisticated, engaged youth while the over-40 demographic swells, and both are powered by technology; the volatility in commodity and energy prices; and a “reset” in consumer values that has made having the so-called social license just as important as having a great product.

These six socio-economic trends will “reshape not only our industry but the world,” Kent says.

A much bigger middle class (with 800 million to 1 billion new people entering this sector from 2010 to 2020) is the greatest economic shift in history, according to Kent. More than 60 percent of this customer base is seen to come from emerging nations.

“It’s quite unlike anything that’s happened before,” Kent says.

All of these factors, he says, are creating paradoxical, counterinquisitive world. There are “constant headwinds” and challenges, yes, but the same presents “incredible tailwinds” and opportunities as well.

“Consumers are judging us not only on quality of our beverage but the character of the companies. There is a moral contract, and the social license as important as great and inspirational products,” Kent says.

With more people having more wealth, more demand for choice, and highly mobile lifestyle, demand for ready to drink, non-alcoholic beverages is growing as well.

However, it is not a simple matter of offering a product at a reasonable price because consumers worldwide are more focused on value. “Not cheap things but brands to engage in. They don’t want to be told, they want to contribute. They are telling us clearly what they want, how, when, in what condition, and what they’re gonna pay for it,” Kent says.

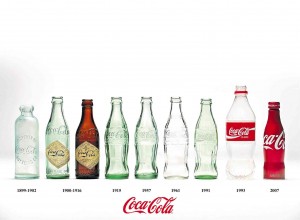

Yes, Coca-Cola executives say, the company has learned the hard way (remember the “new coke” and how rallyists demanded the classic Coke back?) that the brand belongs to the consumers, not the company.

Passion points

“What got us to 125 (years) is not going to sustain us to the next 125,” says Joseph V. Tripodi, EVP and chief marketing and commercial officer.

While strengthening distribution strategies and further building brand value, Tropodi says that marketing has to stay relevant by tapping into passion points globally: football, festivals (or celebrations), social (media), music, and sustainability (“green” technology and processes).

“As we let more consumers know about Coca-cola, we focus on great storytelling but we do it with scale. It’s important to be timeless but relevant. Don’t try to chase ‘cool,’” he says.

Which is why, on Facebook, where Coca-Cola has 26 million followers on a page created by two fans, the company has taken a mostly hands-off approach, Tripodi says.

“Our approach to social media is more passive, allowing fans to come in, and not making promotions. It’s fans first. And it works!” Tripodi says.

Overall, executives says, the one thing that Coca-Cola would not be doing is to rest on its laurels for the past 125 years.

“The fact that we can be a thriving business in our 125th year is a testament to our youth and not our age,” Kent says. “We’ve just scratched the surface of our potential.”