Ayala group celebrates 180th anniversary

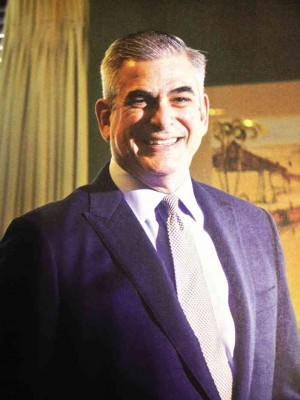

In the office of Ayala Corp. chair Jaime Augusto Zobel de Ayala at Tower One in Makati City are a framed photograph of the old Ayala y Cia building on Echague Street in Manila, portraits of his great-aunt Mercedes Zobel and her husband Joseph McMicking and a framed map of what Hacienda Makati looked like long before the group got into real estate development.

Zobel, who is also chief executive officer of the multibillion-dollar conglomerate that earned P12.8 billion last year, said in a briefing late Friday that he often looks at them to remind him of how far the group has come since pioneering businessmen Domingo Roxas and partner Antonio de Ayala got together in 1834 and put up Casa Roxas, which established a distillery to add value to sugar cane.

They are also tangible reminders that the group managed to become the country’s oldest business house, surviving economic and political upheavals and even painful family differences, because of its strict adherence to values laid down 180 years ago, such as innovation, taking care of people’s trust and going where few dare go.

Casa Roxas, for example, invested the bulk of its assets in a distillery, which produced the iconic Ginebra San Miguel. The distillery was later sold to the Palancas before ending up decades later with San Miguel Corp.

That move marked the initial steps that local entrepreneurs took to set up a manufacturing base in the Philippines and break away from the prevailing business model at that time that revolved around the mere trading of commodities such as sugar.

AYALA CEO Jaime Augusto Zobel de Ayala (standing) Jollibee Foods chair and CEO Tony Tan Caktiong (seated, third from left), and A. Magsaysay Inc. president and CEO Doris Magsaysay-Ho, facilitate the courtesy call on President Benigno Aquino III (rightmost, seated) by fellow ABAC members in 2013.

The pioneering spirit that drove the founders of what would become Ayala Corp. has fortunately remained alive, the 55-year-old Zobel said, allowing the growing company to mark its 180th year, a feat that no other local conglomerate has achieved.

Zobel said the group’s 180th anniversary was a good time to recognize and reflect on the company’s legacy and give the Ayala group’s employees, especially the young ones, a sense of history that will put into context the steps that the current leadership led by Zobel and his younger brother, Ayala Corp. chief operating officer Fernando Zobel de Ayala, are taking.

Zobel shared that when he joined the group in 1981 as an equities analyst, Ayala Corp. was a much smaller company with an annual income of just around P200 million, launching one or two high end real estate projects a year.

He said the group’s growth started to accelerate in 1968, when Ayala converted from a family partnership into a full-fledged corporation.

Zobel said that the major step the family took to become a corporation opened up new ways for the company to raise capital, thus giving the group the flexibility to quickly jump on investment opportunities.

AYALA’S present-day headquarters at Tower One and Exchange Plaza is at the heart of the bustling business, commercial, and financial district that it developed beginning 1948.

“It is an understated move that has not been appreciated enough,” said Zobel, explaining that the transformation gave a new complexion to the group, making it much more professional and equipping it with the financial resources and discipline to compete against local and foreign counterparts.

That ability to raise capital, he said, remains a source of pride and strength for the group, the reins of which he took over in 2006.

Raising capital, whether through equity or debt issues, becomes even more important today as the company invests aggressively in big-ticket projects, such as power and infrastructure.

Zobel believes the group is ready to increase its presence in sectors regulated by the government, given its experience in the water distribution business through Manila Water Co.

Zobels’ father, chair emeritus Don Jaime Zobel, did not go into heavily regulated businesses as advised by his father, but his two sons charted a new course for the group.

“Fernando and I went ahead because you can scale up in these areas. You can really make a difference,” said Zobel.

The Ayala Corp. that the two brothers joined was more into real estate development, banking and insurance, but Zobel defines it now as an investment holding company that is ready to take advantage of any opportunity that inevitably opens up to those who are willing to take measured risks.

According to Zobel, he still wonders why many people still perceive the company as “conservative,” when it has been a trailblazer throughout its history, from the setting up of the distillery in 1834 to the printing of the first bank note in 1852, the establishment of the first public mass transportation system in 1888 to the first ATM network in 1990 and mobile savings in 2009.

“We are conservative financially, but not conservative about entering new spaces,” Zobel said.

Zobel also said that power and infrastructure would be major areas of focus for the company going forward as these present scale and are aligned with the national development agenda, which has long guided the group’s investment decisions.

He shared that the company put up Integrated Microelectronics in 1980, for example, in response to the call to participate in the country’s fledgling export industry.

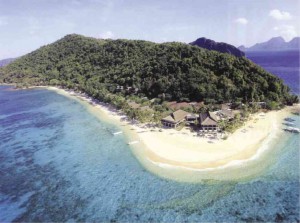

THE AYALA group is taking advantage of bright prospects in tourism through investments in El Nido Resort in Palawan.

Ayala also went into the water distribution and telecommunications sectors because the Ramos administration championed privatization.

Today, the call is for private sector participation in infrastructure development, and Zobel said Ayala Corp. is more than ready to respond, thus the goals to have 1,000 megawatts of power plants in its portfolio by 2016 and participate in the bidding for projects under the Aquino administration’s flagship public-private partnership program.

The future looks bright for Ayala Corp., which has a combined market capitalization of over P1 trillion. Zobel said the company would look firmly ahead but always with an eye on its past.

The company may dramatically change, but for the families that set the long-term strategic vision for Ayala Corp., some things like the premium given to a pioneering spirit, innovation and trust, stays the same.