Asian shares mixed following China, Japan data

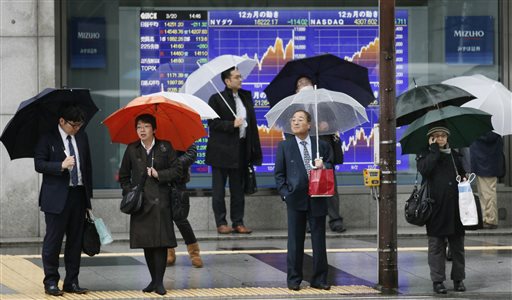

People stand in front of an electronic stock board of a securities firm in Tokyo on March 20, 2014. Asian markets were mixed Tuesday, April 1, as official data showed a slight pick-up in Chinese manufacturing while a closely watched survey showed Japanese business confidence at a more than six-year high. AP PHOTO/KOJI SASAHARA

HONG KONG—Asian markets were mixed Tuesday as official data showed a slight pick-up in Chinese manufacturing while a closely watched survey showed Japanese business confidence at a more than six-year high.

Sentiment was also buoyed by comments from the head of the US Federal Reserve underlining its commitment to monetary easing, while tensions in Ukraine eased as Russia partially withdrew troops from its border.

Tokyo fell 0.24 percent, or 35.84 points, to finish at 14,791.99 despite a fall in the yen against the dollar, while Japan ushered in its first sales tax hike since 1997. Sydney dipped 0.10 percent, or 5.6 points, to 5,389.2 and Seoul climbed 0.32 percent, or 6.37 points, to 1,991.98.

Hong Kong rallied 1.34 percent, or 297.48 points, to 22,448.54 and Shanghai added 0.70 percent, or 14.15 points, to 2,047.46.

China said its official purchasing managers index (PMI) of manufacturing activity came in at 50.3 for March, up slightly from February’s eight-month low of 50.2. A figure above 50 points to growth while anything below indicates contraction. Economists had forecast the figure to remain unchanged.

Article continues after this advertisement“The PMI index rose slightly in March and ended the trend of falling for three consecutive months… it still indicates economic growth will stabilize in the future,” Zhang Liqun, an economist at the state-backed Development Research Center, was quoted as saying in a statement from the National Bureau of Statistics.

Article continues after this advertisementHowever, banking giant HSBC said its own PMI for the country had fallen to 48.0 last month from 48.5 in February, and worse than its initial estimate of 48.1.

A recent run of weak data from China— including on trade, investment and output—has fueled speculation that policymakers will unveil measures to kickstart growth in the Asian economic giant and driver of global growth.

“The rebound this time reflects the economy remained weak, but it’s slightly better than market expectations,” said Zhou Hao, a Shanghai-based economist with ANZ bank.

“I expect the government to be more active… arranging fiscal expenditure in advance for some lagging projects,” he told AFP.

Japan business confidence rises

In Japan, the central bank’s Tankan survey showed business confidence in January-March had surged to its highest level since the December quarter of 2007, the latest indication that the economy is slowly picking up.

However, the news was slightly shaded by a suggestion that investment in the next quarter would be tepid and sentiment lower, possibly as a result of the sales tax rise that critics warn could throw an economic recovery off course.

US stocks ended higher after Fed chair Janet Yellen said unemployment was still a big challenge for the economy and that the bank will continue with extraordinary monetary easing measures until the jobless rate falls significantly.

“The recovery still feels like a recession to many Americans, and it also looks that way in some economic statistics,” she said.

The comments will soothe investors after markets tumbled last month in response to a hint from Yellen that interest rates could rise early next year after the Fed winds down its stimulus program.

On Wall Street the Dow rose 0.82 percent, the S&P 500 added 0.79 percent and the Nasdaq jumped 1.04 percent.

Focus will now turn to the release Friday of US non-farm payrolls data, which could provide clues about possible Fed plans for the bond-buying scheme at its next meeting.

The dollar bought 103.25 yen in Tokyo trade, compared with 103.22 yen Monday in New York and well up from the 102.95 yen level earlier Monday in Asia.

The euro fetched 142.40 yen and $1.3789, from 142.15 yen and $1.3772.

In oil trade, New York’s West Texas Intermediate for May delivery dropped 47 cents to $101.11 a barrel in afternoon trade and Brent North Sea crude for May shed 23 cents to $107.53.

Gold fetched $1,284.41 an ounce at 1045 GMT compared with $1,293.64 late Monday.

In other markets:

— Bangkok added 0.82 percent, or 11.22 points, to 1,387.48.

Coal producer Banpu lost 0.89 percent, or 0.25 baht, to 27.75 baht, while Bangkok Bank rose 1.40 percent, or 2.50 baht, to 181 baht.

— Jakarta gained 2.22 percent, or 105.66 points, to 4,873.93.

Cement producer Semen Indonesia jumped 4.43 percent to 16,500 rupiah, while palm oil firm Sinar Mas Agro Resources and Technology fell 4.20 percent to 6,850 rupiah.

— Kuala Lumpur ended flat, losing just 0.08 percent, or 1.45 points, to 1,847.76.

Telekom Malaysia fell 0.3 percent to 5.87 ringgit, while plantation giant Sime Darby shed 0.5 percent to 9.26.

— Manila surged 1.34 percent, or 86.01 points, to 6,514.72.

Metropolitan Bank rose 3.10 percent to 79.70 pesos and Ayala Land was 1.67 percent up at 30.40 pesos.

— Mumbai rose 0.27 percent, or 60.17 points, to 22,446.44.

Gitanjali Gems rose 6.87 percent or 4.05 rupees to 63 rupees, while Godrej Consumer Products gained 5.37 percent, or 45.75 rupees, to 897.45 rupees.

— Singapore climbed 0.31 percent, or 9.90 points, to 3,198.52.

United Overseas Bank rose 0.42 percent to Sg$21.74 while real estate developer Capitaland gained 0.69 percent to Sg$2.91.

— Taipei rose 0.27 percent, or 23.87 points, to 8,873.15.

Taiwan Semiconductor Manufacturing Co. gained 0.84 percent to Tw$119.5 while smartphone maker HTC was 0.65 percent higher at Tw$154.0.

— Wellington dropped 0.34 percent, or 17.46 points, to 5,122.52.

Telecom was down 0.41 percent at NZ$2.43 while Contact Energy added 0.56 percent to NZ$5.35.—Danny McCord