MANILA, Philippines — The local stock barometer slipped on Thursday ahead of a keenly awaited meeting by the local central bank, which has indicated a bias to shift to a monetary tightening cycle.

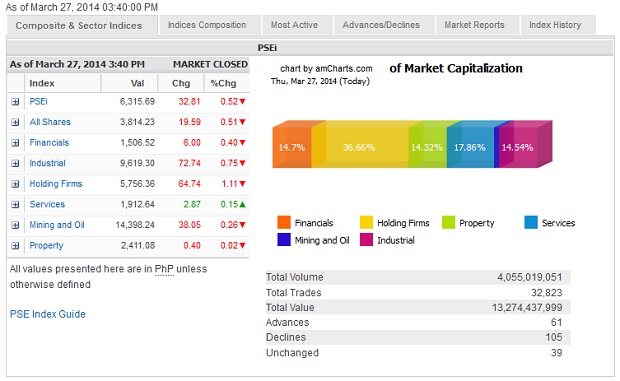

The Philippine Stock Exchange index slipped by 32.81 points or 0.52 percent to close at 6,315.69.

Apart from some interest rate jitters, the local stock market was weighed down by an equity deal in Petron Corp., whose shares fell by 12.69 percent following a discounted share sale by the company’s retirement fund.

The day’s decline was led by the holding firm counter, which fell by 1.11 percent.

Value turnover for the day swelled to P13.27 billion due to the block transactions on Petron following a $120-million private placement deal.

There were 61 advancers, which were overwhelmed by 105 decliners while 39 stocks were unchanged.

Dealers said the market would need to consolidate first after the recent run-up alongside recent downward pressures from the US market.

Other big decliners was JG Summit (-2.04 percent) along with SMIC and DMCI which both fell by over 1 percent. AGI, URC, SMPH, GTCAP, Meralco and Megaworld likewise declined.

Outside of the main index, there was heavy selling on Nihao (-5.15 percent).

On the other hand, the day’s losses were curbed by the modest gains posted by PLDT, AC, ICTSI, ALI and BDO.

SMC’s food unit Purefoods surged by 15 percent after the latter declared a special dividend of P48 per share on top of regular cash dividend of P1.20 per share. For investors, this translated to an attractive yield of 21 percent.

RELATED STORIES

Bangko Sentral seen holding off rate hike