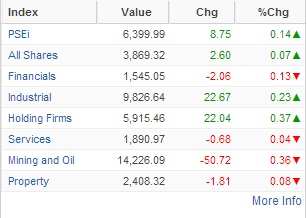

The main-share Philippine Stock Exchange index recouped 8.75 points or 0.14 percent to close at 6,399.99. Across the region, risk-taking was tempered by escalating tension in Ukraine.

The local stock market encountered rough trade early on but recovered late in the session. The positive close was led by the industrial and holding firm counters, which made up for the slack in the services, mining/oil and property counters.

Despite the PSEi’s modest gain, market breadth was negative, with 73 advancers outnumbered by 92 decliners.

The index was led higher by JG Summit (+2 percent), which was likewise the day’s most actively traded company. SMPH, AEV and Jollibee also all rose by over 1 percent.

ICTSI, BDO, MPI, BPI and AGI also contributed modest gains to the index.

MWC, despite its exclusion from the PSEi in a realignment that took effect on Monday, rose by 1.27 percent as the water utility announced a new offshore project in Yangon City, Myanmar.

On the other hand, the day’s gains were tempered by the decline of Meralco, AC and Megaworld, which all slumped by over 1 percent. ALI, SMIC, URC, AP and Metrobank also closed lower.

After a “meaningful pullback,” local stock brokerage DA Market Securities said the market might be lifted by the return of medium to long-term investors buying on dips.

“A possibility is a consolidation within the period of slow corporate/economic news, to creating a healthy base of support for the next leg up,” DA Market said on early Monday.

The next formidable barrier would be at 6,648 and major levels at 6,700-6,800, the brokerage said. However, an attempt to break major resistance might signify a return to previous highs seen last year– 7,000 and 7,400, it said.

“We are delighted for prospects of another upgrade as indicated by the BSP (Bangko Sentral ng Pilipinas). This may be the next strong catalyst to fuel the PSEi’s rally,” it said.