BSP: Refund to ATM scam victims banks’ call

The Bangko Sentral ng Pilipinas (BSP) is leaving it to the discretion of individual banks whether to refund the victims of automated teller machine (ATM) fraud.

The BSP said it could not at this time require banks to give a refund because of the complexity of the issue.

According to BSP Assistant Governor Noe Ravalo, on one hand, the BSP agrees with the view of Sen. Grace Poe that banks should be accountable for the security concerns affecting their customers.

Competing interests

On the other hand, however, it can be difficult to verify the accuracy of customers’ claims that they have been victimized by ATM fraud, Ravalo said.

“If the issue is one of accountability, we (BSP) support that. But how does one manage the competing interests of [banks and complaining customers]? Anyone can always claim that they lost money,” said Ravalo, who heads the central bank’s customer protection unit.

Poe, chair of the Senate committee on public order that is conducting a hearing on the increasingly serious incidents of ATM fraud, said on Thursday that she favored the passage of a law that would require banks to reimburse depositors who had been defrauded by ATM cloning.

At the committee hearing last week, bank officials said depositors lost some P220 million to ATM fraud in 2013.

Ravalo said he was confident that most, if not all, banks would positively respond to suggestions that they give refunds to clients who have been victimized.

Based on trust

According to Ravalo, the business of banking depends very much on the confidence of its customers and the failure to entertain serious concerns over security could adversely affect the banks’ relationship with their clients.

“A bank most likely will not want to alienate customers who trusted it for so long. Although, of course, banks have to deal with the need to trust their customers [that their claims are true],” Ravalo said.

Guard ATM cards

Meantime, the BSP has reminded the public to be extra careful in the way they handle their ATM cards.

“Do not leave your ATM cards unattended and do not give your PINs (personal identification numbers) to anyone,” Ravalo said.

He also strongly urged people not to use commonplace passwords for their ATM cards, such as “123456” or the numbers corresponding to their birthdays.

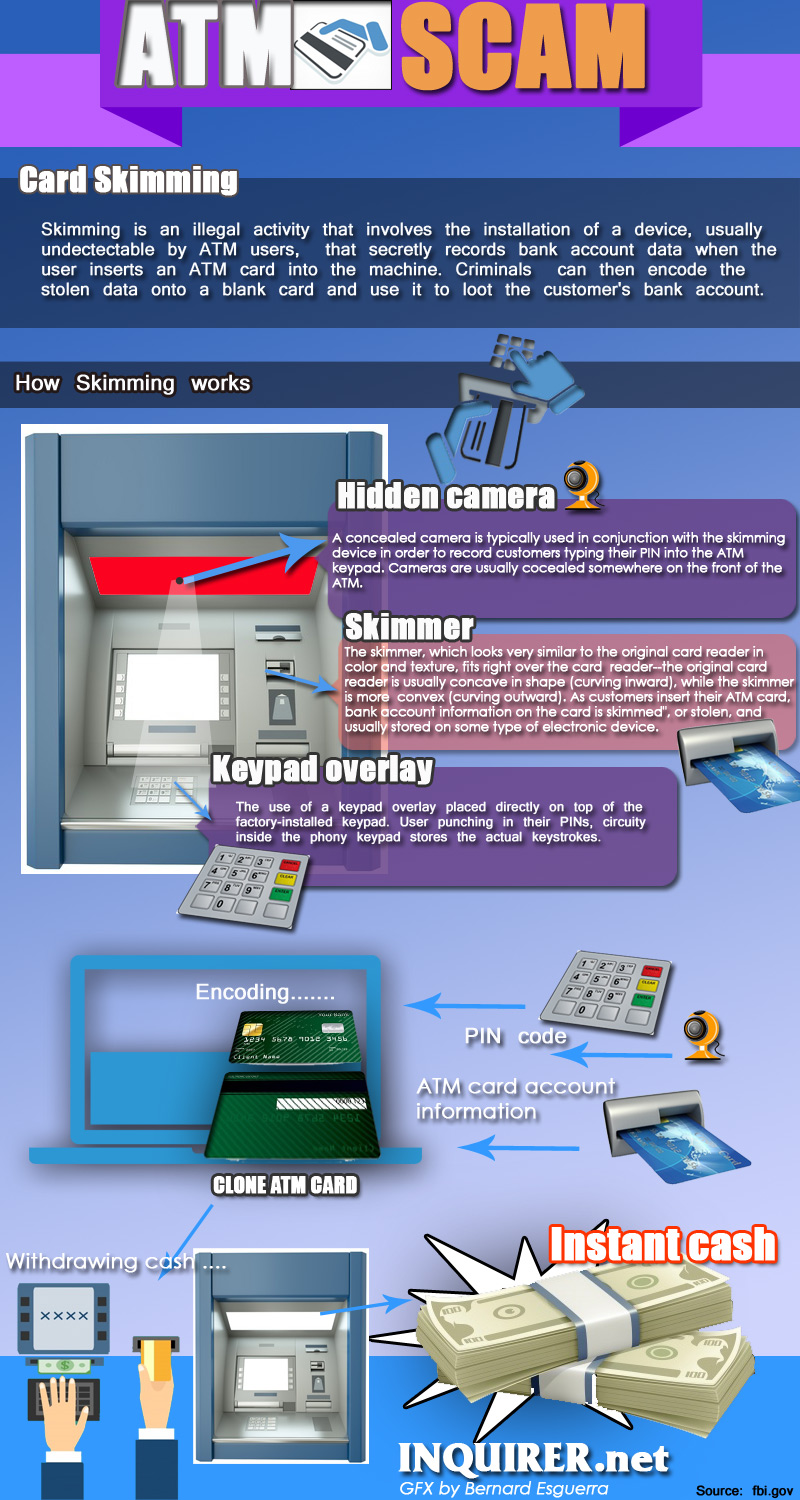

Ravalo said the syndicates involved in ATM fraud were becoming more sophisticated. As such, the use of technology for the convenience of customers also must come with appropriate security measures, he said.

He said ATM fraud was a global experience, not just in the Philippines. He said many countries, including the United States, have had cases of ATM fraud.

Ravalo said the BSP had already required banks in the country to upgrade their systems so they could shift to new ATM cards with better security features.

RELATED STORIES

Banks urged: Return money in ATM scams

PSG man in ATM card cloning sacked