Australia’s main index was hit by a slump in Qantas shares after the national carrier said it would slash 5,000 jobs under restructuring plans as it announced a half-year net loss of more than US$200 million.

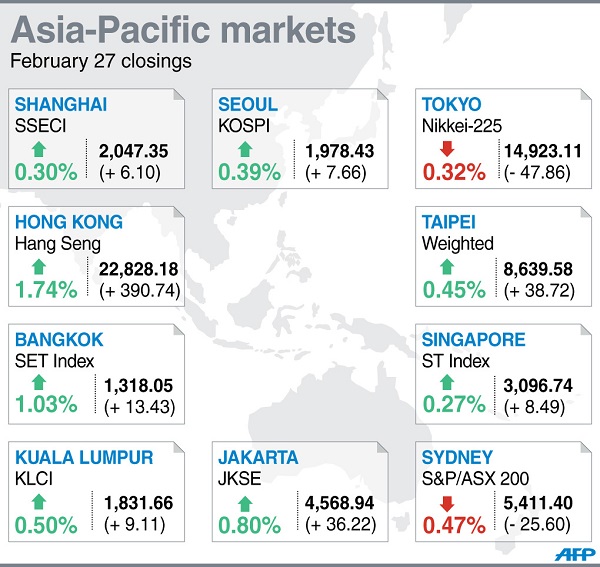

Shanghai added 0.30 percent, or 6.10 points, to close at 2,047.35 and Hong Kong rallied 1.74 percent, or 390.74 points, to 22,828.18. Seoul finished 0.39 percent higher, gaining 7.66 points to 1,978.43.

But Tokyo slipped 0.32 percent, or 47.86 points, to 14,923.11 and Sydney fell 0.47 percent, or 25.6 points, to 5,411.4.

Mumbai was closed for a public holiday.

With few catalysts to drive business, investors are waiting to find out Yellen’s views on the US economy when she sits before the Senate Banking Committee later Thursday.

She is unlikely to deviate from her comments to the House of Representatives’ committee two weeks ago but investors will be interested to hear whether the bank expects the severe weather that paralyzed parts of the country to have affected growth prospects.

A recent spate of downbeat data out of the United States over the past two months, including jobs growth, has been blamed on the cold snap.

Yellen’s comments could give an idea of her plans for the Fed’s stimulus program, which has been reduced in each of the bank’s past two policy meetings.

“Her comments on the current situation of the US economy, tapering (of its stimulus) and forward guidance (on interest rates) will be closely watched,” Barclays currency analyst Shinichiro Kadota said in a note to clients.

Wednesday saw the release of data showing a healthy 2.2 percent jump in US new home sales in January, despite the weather.

On Wall Street the Dow rose 0.12 percent, the S&P 500 was flat and the Nasdaq gained 0.10 percent.

In currency trade the dollar was at 102.34 yen compared with 102.38 yen in New York, while the euro fetched 140.00 yen and $1.3674 against 140.11 yen and $1.3683.

In Sydney, struggling Qantas slumped nine percent after it said it will axe 5,000 jobs, freeze pay, defer aircraft deliveries and suspend growth at Asian offshoot Jetstar while warning of more pain to come.

The airline, battling record fuel costs and fierce competition from subsidised rivals, posted an interim net loss of Aus$235 million (US$210 million) in the six months to December 31.

Oil prices fell. New York’s main contract, West Texas Intermediate for April delivery, was down 29 cents at $102.30, while Brent North Sea crude for April fell 21 cents to $109.31.

Gold fetched $1,324.17 an ounce at 0810 GMT, compared to $1,340.05 late Wednesday.

In other markets:

— Taipei rose 0.45 percent, or 38.72 points, to 8,639.58.

Smartphone maker HTC fell 1.81 percent to Tw$136.0 while Taiwan Semiconductor Manufacturing Co. climbed 0.47 percent to Tw$108.0.

— Wellington fell 0.18 percent, or 8.86 points, to 4,964.34.

Air New Zealand was up 0.86 percent at NZ$1.765 and Fletcher Building slipped 2.07 percent to NZ$9.47.

— Manila closed 0.51 percent higher, adding 32.19 points to 6,354.79.

Universal Robina gained 2.19 percent to 140 pesos while Megaworld Corp. rose 1.22 percent to 4.15 pesos.