MANILA, Philippines — The local stock index succumbed to further profit-taking on Tuesday, but stayed above the 6,000 support level, tracking the jittery sentiment on emerging markets ahead of a crucial US Federal Reserve meeting.

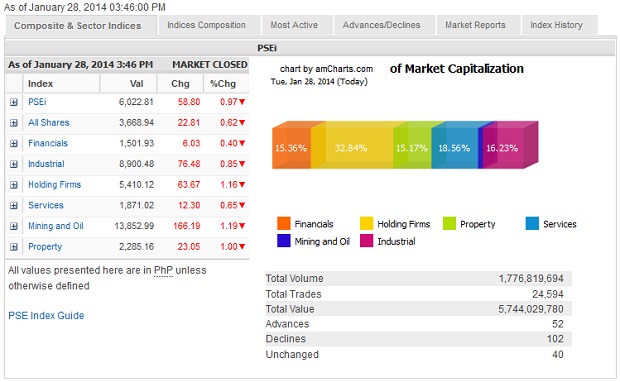

Pulling back for the second straight session, the main-share Philippine Stock Exchange index shed 58.8 points or 0.97 percent to close at 6,022.81.

All counters ended in the red but the worst hit were the holding firm, mining/oil and property sub-indices which fell by over 1 percent.

The Federal Open Market Committee was set to meet January 28-29 to decide on whether further cuts to the monetary stimulus will be done. This week’s Fed meeting, the first for the year, will also be the last over which Ben Bernanke will preside. Janet Yellen is set to take over this post.

Meanwhile, this emerging market turmoil has likewise been aggravated by fears of a liquidity crunch in China.

Turnover at the local stock exchange thinned out to P5.74 billion compared with around P7 billion in the last few days. There were twice as many decliners for every single gainer in the market.

Investors sold down shares of URC, GTCAP, ALI, AC, Jollibee, MPI and JG Summit, which all fell by 2 percent while Megaworld, Metrobank, Globe and RLC declined by over 1 percent. PLDT, SMIC and AP also contributed to the decline.

On the other hand, among those that bucked the day’s upswing were SM Prime (+1.36 percent), AGI (+0.37 percent) and LTG (+1.13 percent).

SM Prime expanded Megamall, already its top-grossing shopping mall in the country, by 101,000 square meters with the opening of premium wing Mega Fashion Mall. The mall developer has likewise announced the expansion of other malls, including Mall of Asia, for an additional investment of P10 billion in the next two to three years.

RELATED STORY