PH stock index retreats to 5,923.12 as market loses steam from initial rally

MANILA, Philippines — The local stock barometer went on a roller coaster ride on Thursday, initially retesting the 6,000 level on relief rally over the US Federal Reserve’s modest tapering of its monetary stimulus but losing steam at close.

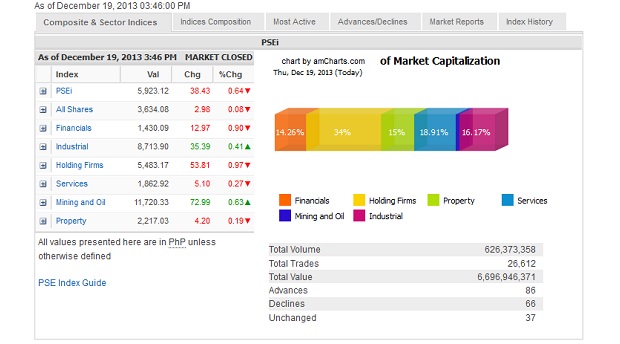

Ending a four-day run-up, the main-share Philippine Stock Exchange shed 38.43 points or 0.64 percent to close at 5,923.12.

The main index reached as high as 6,059.78 in early trade, tracking an upbeat overnight trading in Wall Street. The Dow Jones Industrial Index (DJIA) surged by 292.71 points to 16,167.9 after the US Federal Open Market Committee announced a reduction in its monthly bond-buying operations to $75 billion from $85 billion while giving assurance that monetary policy would remain easy moving forward.

“But eventually profit-taking set in, which dragged the market to negative territory,” said Manny Cruz, chief strategist at Asiasec Equities Inc.

“Apart from profit-taking, there’s hesitation from some investors given tapering will result in the strengthening of the US dollar against the peso,” Cruz said.

Tracking the decline in many regional currencies, the peso depreciated to 44.435 from Wednesday’s 44.260 against the US dollar.

Joseph Roxas, president of Eagle Equities Inc., said the local stock market reversed earlier gains as investors took profits.

But even as the decline in large-cap stocks weighed down the main index, there were still more advancers (86) than decliners (66) in the overall market. The day’s biggest PSEi lagger was RLC (-4.32 percent) while GTCAP, BPI, AEV, BDO and AP declined by over 2 percent. ICTSI, Jollibee, Globe and AC also slipped by over 1 percent.

On the other hand, LTG (+4.25 percent) led the stocks that bucked the decline while Bloomberry and MWC also rose by over 3 percent. EDC, SM Prime, Petron, FGEN and Semirara also eked out gains.

By counter, the financial, holding firms, services and property sub-indices ended lower while the industrial and mining/oil counters crept higher.

“Looking at the performance of the DJIA, it seems that the market has priced the taper. With the Fed move quite small, any future taper would be data-dependent and their reiteration (would be) to keep interest rate low. This should set risk assets to bounce and the greenback stronger,” said Banco de Oro Unibank chief strategist Jonathan Ravelas.

With this development, Ravelas said the PSEi might try the 6,000-6,100 levels and the US dollar/peso exchange rate to try the 44.50/44.75 levels. “As for interest rates this should provide a reason for rates to move slightly higher,” he said.

Although the recent move started the much-ballyhooed tapering of easy money, the US Fed committed to keep interest rates low “well past the time that the unemployment rate declines below 6.5 percent, especially if projected inflation continues to run below” its 2 percent goal.

In a research note, British investment bank Barclays said the US Fed had surprised the market on two fronts: first, by announcing the start of asset tapering earlier than investors had anticipated; second, by providing forward-looking comments that helped reduce rates risk premium.

Barclays said this move should benefit emerging markets (EM) assets through 2014. “The large sell-off of EM assets since May this year has been consistent with the risk that a reduction of US monetary policy stimulus would lead to sharply higher core market yields, pulling capital out from EM and weighing on EM asset prices and growth. This risk has diminished and supports our view that 2014 is likely to experience some positive portfolio inflows, albeit more directed to equities than bonds,” the bank said.

RELATED STORY:

PSEi climbs back to 6,000 after US Fed Reserve’s modest stimulus tapering