Wanted: Simplified taxation

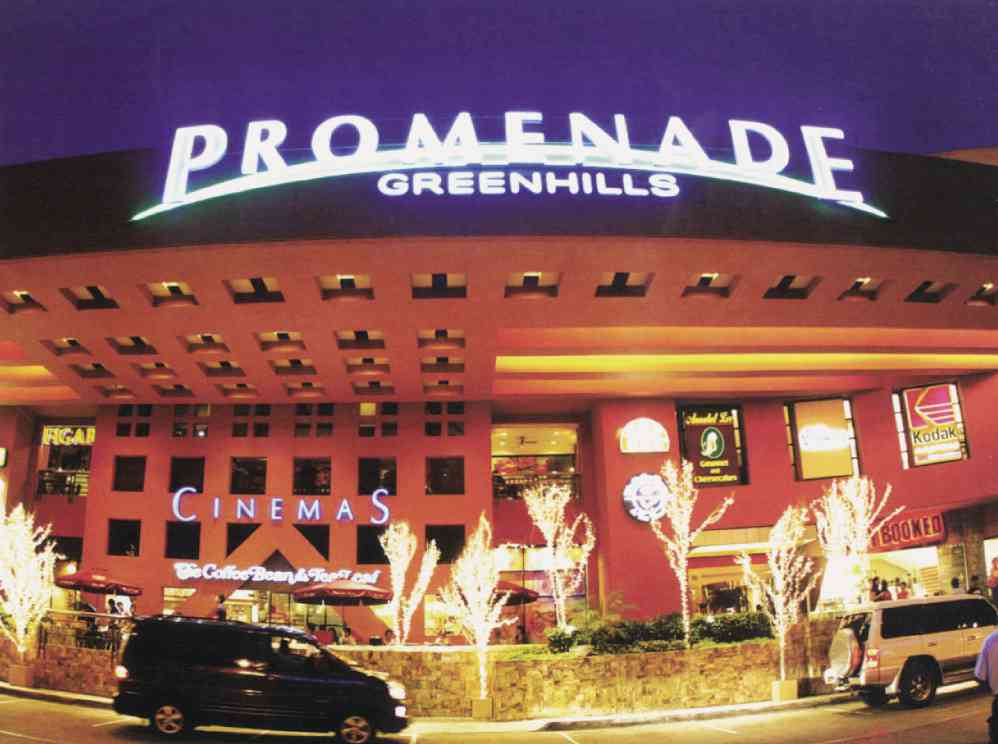

MUSIC Museum opened its doors to the public on Aug. 8, 1988, and has led to other retail developments within the Greenhills Shopping Center such as Promenade Greenhills(top)

On Nov. 24, we got a respite from the series of bad news brought about by Supertyphoon “Yolanda” and the controversial PDAF.

Cong. Manny Paquiao (CMP) convincingly defeated Brandon Rios after dominating the 12-round welterweight bout to the delight of his fans.

It was a much-hoped-for victory not only for him but for the entire country.

The following day, he came back to the Philippines triumphant in cloud nine, raring to give his share to the relief efforts for the victims of Yolanda.

Tuesday was a different day. The papers came out with a “bomb.”

Article continues after this advertisementThe Bureau of Internal Revenue (BIR) has issued an order to garnish CMP’s bank accounts due to his failure to settle his tax liabilities amounting to P2.2 billion.

Article continues after this advertisementThis became the favorite topic not only of the media but also the public in general.

It elicited much interest, even among ordinary folks, who may not care about taxation.

A word war ensued between CMP’s camp and the BIR.

From what I have heard from an interview with BIR Commissioner Kim Henares, the P2.2B tax assessment consists of unpaid income tax and value-added tax (VAT) for the taxable years 2008 and 2009, plus corresponding penalties (50 percent surcharge, and 20 percent interest a year).

The BIR found out that in 2009, CMP’s income derived from the US was not declared in his Philippine income tax return (ITR).

There were also income payments (talent fees) to him by local companies which were not reported in his ITR.

Under current rules, such income payments are subject to creditable withholding tax which the local payor is required to remit and report to the BIR.

By cross-matching the income payments reported by the payor with those reported by the income recipient, in this case CMP, the BIR can easily detect any undeclared income .

It will be recalled that this cross-matching procedure (referred to as RELIEF system in the BIR) was instrumental in the disclosure of under-reporting of income by many taxpayers including prominent actors/actresses and businessmen, and the consequent issuances of significant assessments for unpaid income tax and VAT.

MUSIC Museum Group CEO Precy Florentino during the 25th anniversary celebration thanks every one who has been a part of the Music Museum’s first 25 years.

Among taxpayers, it is a common misunderstanding that when they receive income already subjected to withholding tax, there is no more obligation on their part to report said income in their ITRs.

Moreover, although VAT on professionals, athletes, actors/actresses, etc. has been in place for many years, many are still unaware that their gross receipts of professional, talent and service fees are subject to 12 percent VAT.

Unfortunately, ignorance of tax laws excuses no taxpayer.

So how can a taxpayer like CMP avoid big tax assessments? The answer is easy. Declare all income, whether derived from other countries or from within the Philippines, in your income and VAT returns.

Claim the allowable deductions from your income, that is, the costs and expenses incurred in the pursuit of the income-generating activities provided they are properly documented. Alternatively, claim the 40 percent optional standard deduction instead of the itemized deductions, to be spared of the requirement to submit appropriate supporting documents.

If advanced tax payment has been made by way of creditable withholding tax (CWT), claim it as a deduction from the total income tax due.

For income tax paid to foreign countries like the US, claim it as a foreign tax credit—like a CWT.

Take note, however, that in the case of foreign income tax payments, it is possible that not the whole amount of such tax payments may be allowed as deduction as this is subject to certain limits based on the formula provided in Section 34(c)4 of the Tax Code.

Is there a way to simplify the taxation of income derived by such individuals as athletes, actors, professionals, etc.?

Actually, allowing the 40 percent optional standard deduction, instead of the itemized or detailed deductions, is a way by which the current tax law has simplified individual taxation. However, despite the availability of this method of deduction, there are still many individual taxpayers who become “victims” of tax assessments.

The major reason is the non-reporting of correct income for income tax purposes and gross receipts of income for VAT purposes.

What then can be done to address this perennial problem?

One solution that comes to my mind, but this of course requires legislation which normally is a tedious and lengthy process, is to expand the current list of income subject to final withholding tax to include payments to professionals, athletes, actors/actresses and such other individual recipients of service and talent fees.

This means that when such income payments are made by local payors, the taxes to be withheld from the payments will be considered final tax and no longer creditable tax, meaning to say deductible against the final income tax due.

The burden of remittance of the final withholding tax rests on the payors.

In this manner, the recipients of such income payments need not worry about reporting and paying income tax to the BIR. To be fair to taxpayers, this final withholding tax system should just be optional to taxpayers, meaning to say that those who prefer to have their fees subjected to creditable withholding tax should be allowed to take this option instead.

Appropriate procedures can be established to ensure proper implementation of this new system and avoid tax revenue leakages.

This concept is not exactly new as, currently, there is the so-called substituted filing of ITRs for employees whose employers have withheld the correct income taxes due and remitted and reported the said taxes to the BIR.

In such case, the employees do not have to file ITRs with the BIR.

The same is true in the case of the VAT under Revenue Regulations 14-2003, whereby the seller of goods or services shall be subject to VAT withholding at source provided he executes a waiver of privilege to claim input tax credit, which refers to the VAT paid on purchases of goods or services that may be claimed as deduction against the VAT due on sales of goods or services.

This means that the seller of goods or services shall no longer file VAT return provided he makes his sales to only one customer/payor who withholds the VAT from the payment to be made to the seller.

As the taxpayer (CMP) currently in hot seat is a legislator, I thought it should not be a difficult battle to have the proposal translated into a bill and passed into law if found to be sound and fair to both the government and the taxpayers.

Calling Congressman Manny Paquiao…. may this be your next victorious fight.

(This article reflects the personal opinion of the author and does not reflect the official stand of the Management Association of the Philippines. The author is the Secretary of the MAP for 2013, the Vice President of MAP for 2014, and an Independent director of the QBE Insurance (Philippines), Inc. Feedback at <[email protected]> and <[email protected]>. For previous articles, please visit www.map.org.ph)