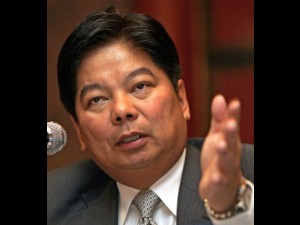

Bangko Sentral ng Pilipinas Governor Amando M. Tetangco Jr.: Positive for global markets. FILE PHOTO

MANILA, Philippines—The recent budget deal in the United States, which eliminates the chance of a Federal debt default, should calm global financial markets and allow investors to focus on performers like the Philippines.

Bangko Sentral ng Pilipinas Governor Amando M. Tetangco Jr. said the bipartisan deal between Republicans and Democrats in the US Congress would ease pressure on global markets.

“These should also help market participants to shift their focus again on country fundamentals,” he told reporters on Thursday.

Earlier this week, Democrat and Republican negotiators unveiled a fixed two-year spending deal for the US Federal Government, easing fears over a repeat of last October’s shutdown of government services.

If approved, the deal would fix federal spending at $1.012 trillion next year and $1.014 trillion in 2015. This would be between the $1.058 trillion proposed by Democrats in the Senate and the $967 billion sought by the House, which is controlled by Republicans.

This would avert a possible US Treasury default—which the US government came close to last October as it neared its legal borrowing limit—that could trigger a crisis worse than 2008.

Apart from concerns over its fiscal policy, the US Federal Reserve is also on the cusp of slashing its monthly bond-buying program that has been in place since late 2009.

The US Federal Reserve has been buying $85 billion worth of mortgage-backed securities and US treasury bills since 2009 in a bid to keep interest rates low to spur economic growth.

With the US economy starting to recover, the Fed said it would start reducing its monthly asset purchases before ending them entirely by 2014.

Tetangco said the US budget deal partly lifted the veil of uncertainty in global financial markets.

“To the extent that these developments would smooth out kinks in the normalization process for the US and help anchor US growth, these should be positive for global markets, including emerging markets,” Tetangco said.