Mighty Tobacco Corp. willing to open books

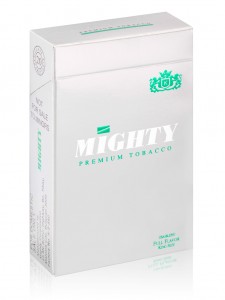

MANILA, Philippines—Mighty Tobacco Corp. on Wednesday welcomed calls for authorities to examine its books amid allegations that it has been dodging taxes and customs duties in order to price its products cheaply and undercut market rivals.

But the Bulacan-based maker of low-priced cigarettes said the government should also examine the books of its competitors to ensure proper compliance by the entire industry with the higher tax levies imposed earlier this year by the Sin Tax Reform Law.

“We are not hiding anything,” said Mighty Tobacco legal counsel Miguelito Ocampo in a press statement. “Our operations, from sourcing of raw local and imported materials to manufacturing, withdrawals and marketing, are transparent and are strictly monitored and liquidated by the Bureau of Customs (BOC) and the Bureau of Internal Revenue (BIR).”

Finance Secretary Cesar Purisima recently ordered the BIR and the BOC to investigate allegations that Mighty Tobacco has been selling its products below cost, amid suspicions it had been evading excise tax payments by underdeclaring its cigarette production.

All this happened as the higher sin tax levies imposed this year forced large tobacco firms to raise their prices, forcing smokers to shift to cheaper brands such as those offered by Mighty Tobacco.

Article continues after this advertisementParticularly hit hard by the increased sin tax levy is Philip Morris Fortune Tobacco Corp.—the country’s largest cigarette manufacturer—which the executive branch had targeted last year when it pushed for the passage of the sin tax bill.

Article continues after this advertisementAccording to Ocampo, it “would be fair if the investigation is also done to other cigarette manufacturers particularly the giant and powerful multinationals who are always complaining against our company.”

He urged Congress to pass an antitrust law to protect local cigarette manufacturers.

RELATED STORY: