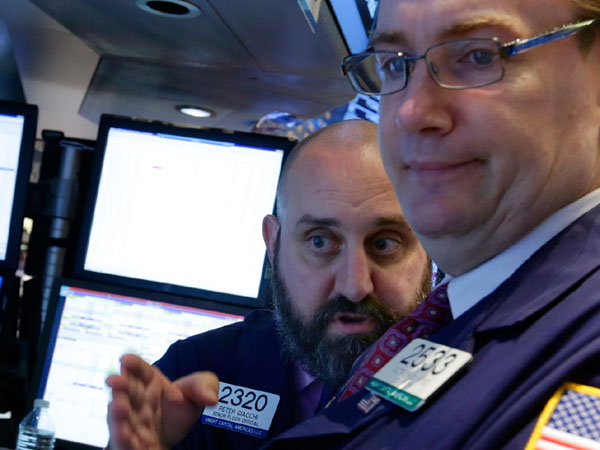

In this Oct. 9, 2013, photo, specialists Peter Giacchi, left, and Patrick King confer at a trading post on the floor of the New York Stock Exchange. US stocks Monday, Oct. 28, 2013, ended a quiet day essentially flat ahead of a two-day US Federal Reserve policy meeting that concludes Wednesday. AP

NEW YORK CITY—US stocks Monday ended a quiet day essentially flat ahead of a two-day US Federal Reserve policy meeting that concludes Wednesday.

The Dow Jones Industrial Average slipped 1.35 points (0.01 percent) to 15,568.93.

The broad-based S&P 500 tacked on 2.34 (0.13 percent) at 1,762.11, a new all-time high, while the tech-rich Nasdaq Composite Index fell 3.23 (0.08 percent) to 3,940.68.

All three indices traded in a fairly narrow range throughout the session amid relatively little news.

However, investors were gearing up for Apple’s after-market earnings release. The tech giant reported earnings fell 8.6 percent to $7.5 billion for its fiscal fourth quarter. Shares were down 2.6 percent in after-hours trading.

The Fed’s Federal Open Market Committee kicks off a two-day monetary policy meeting Tuesday. Although the FOMC is expected to maintain its $85 billion a month asset-purchase program unchanged, investors will be watching for clues about when the pullback might begin.

Monday’s bland trade was typical of days ahead of Fed meetings, said Michael Gayed, chief investment strategist at Pension Partners.

“This entire year has shown that nothing matters except (Fed Chairman) Ben Bernanke so everything is put on hold when you have a Fed meeting ahead,” Gayed said.

Some technology companies that have enjoyed huge increases in 2013 retreated due to profit-taking. These included Facebook (down 3.3 percent), Netflix (down 4.3 percent) and electric-car manufacturer Tesla (down 4.0 percent).

Procter & Gamble and Coca-Cola, two Dow components that fell after reporting earnings last week, were among the biggest winners in the index. P&G rose 1.6 percent while Coke jumped 1.5 percent.

Dow component Merck lost 2.6 percent after earnings fell 35 percent from the year-ago level and revenues slightly lagged expectations. The company announced earlier this month it was cutting 8,500 jobs.

Bristol-Myers Squibb shot up 6.7 percent after announcing promising test results on clazakizumab, which is used to treat rheumatoid arthritis.

Morgan Stanley upgraded Bristol-Myers to “overweight” on the basis of promising cancer treatments the company is developing.

Bond prices fell slightly. The yield on the 10-year US Treasury rose to 2.51 percent from 2.50 percent Friday, while the 30-year increased to 3.60 percent from 3.59 percent. Bond prices and yields move inversely.