MANILA, Philippines—Gokongwei-led retailer Robinsons Retail Holdings Inc. is set to raise $622 million in one of the largest-ever initial public offerings in the Philippines, its main local underwriter said Friday, as more companies sell shares to capitalize on the nation’s surging economy.

Robinsons plans to use the money to boost its store chain from 940 to 1,400, said Dennis Du, executive director of Maybank ATR Kim Eng Capital, the IPO’s domestic underwriter.

“This will be one of the biggest IPOs ever in the Philippines,” Du told Agence France-Presse.

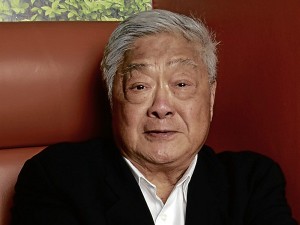

Robinsons, owned by Chinese-Filipino tycoon John Gokongwei, told the Philippine Stock Exchange this week it will sell at least 461.9 million common shares to the public on October 29 at P58 ($1.35) a share, or P26.79 billion ($622 million) in total.

The country’s main business groups have taken to selling shares to raise capital to take advantage of robust economic growth that saw the Philippines’ gross domestic product rise by 6.8 percent last year and 7.6 percent in the first half of 2013.

The Philippine Stock Exchange index is up 13.3 percent this year, after a 33 percent surge last year.

The country’s biggest IPO launched in April when the LT Group Inc. of Lucio Tan, the country’s second-wealthiest man, raised 37.72 billion pesos.

Seventy percent of the Robinsons shares are to be sold to investors abroad and the balance will be sold in the Philippines on Tuesday, according to its prospectus.

Robinsons will list at the Philippine Stock Exchange on November 11, it added.

The retail chain includes department stores, groceries, hardware shops, drugstores, the local franchise to giant US retailer Toys R Us.

As a retailing business in the Philippines Robinsons is second only to the SM group of tycoon Henry Sy, the country’s richest man.

Forbes.com lists Gokongwei as the Philippines’ fifth-richest man with a net worth of $3.4 billion as of July 2013.

The 87-year-old Chinese immigrant is the patriarch of a business empire that also includes airline Cebu Pacific, property, food manufacturing, banking and petrochemicals.

Cebu Pacific’s IPO raised P23.3 billion in 2010.