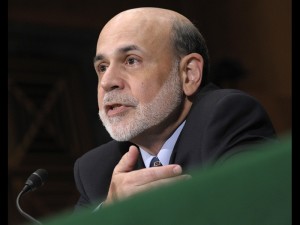

FORESIGHT. In this July 14, 2011 file photo, Federal Reserve Chairman Ben Bernanke testifies on Capitol Hill in Washington, before the Senate Banking Committee hearing to deliver the semiannual Monetary Policy Report. Bernanke told Congress in July that the Fed was ready to act if the economy weakened. AP

SINGAPORE — Oil was higher in Asian trade on Thursday ahead of a speech by US Federal Reserve chief Ben Bernanke, analysts said.

Oil markets were also underpinned by the ongoing Libya unrest as it became increasingly apparent that the North African country will take longer than expected to get its crude production facilities back to pre-crisis levels.

New York’s main contract, West Texas Intermediate light sweet crude for October delivery rose 14 cents to $85.30 a barrel and Brent North Sea crude for October delivery was 21 cents up at $110.36.

“Over the coming week, crude markets will be looking for clearer information on the condition of the Libyan oil and gas infrastructure,” said Sanjeev Gupta, who heads Ernst and Young’s Asia-Pacific oil and gas practice.

Oil prices could drop temporarily if the crisis in the oil-rich North African nation eases, or if strongman Moamer Kadhafi is caught, said SEB Commodity Research analyst Filip Petersson.

“Bearish influences could come from Libya — e.g. if Kadhafi is caught — but these are likely to be short-lived as the market is starting to realize that Libya is highly unlikely to be back at pre-war capacity anytime soon,” he said.

Meanwhile, investors are watching out for Friday’s speech by Bernanke, which will be scrutinised for signs of whether he will support new stimulus measures to juice the sluggish economy.

The US is the world’s largest oil-consuming nation.