Don’t shoot the messenger, DBP lawyer tells Ongpin

Lawyer Zenaida Ongkiko-Acorda on Wednesday insisted that she was the official spokesperson and counsel of the Development Bank of the Philippines (DBP), in a statement she issued the day after businessman Roberto Ongpin said he would have her disbarred for illegally usurping these positions.

Acorda said she was authorized by the bank’s board to act as its spokesperson and “deputized” by the Office of the Solicitor General to handle the case against Ongpin and certain former DBP officials.

“The Solicitor General already announced to the media that I was deputized as one of the lawyers to handle this case,” she said in a statement.

She said that the DBP officials who paid for an ad in the Inquirer claiming that Acorda was never retained by the DBP as its counsel or spokesperson “are some of the respondents in the Ombudsman complaints.”

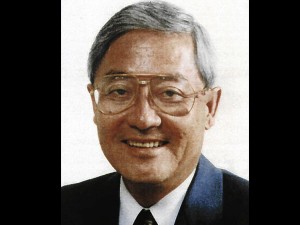

Ongpin has been accused by the new DBP board of colluding with former DBP officials to obtain a P660-milion behest loan to purchase shares of Philex Mining Corp. owned by the bank.

The former trade minister has denied the allegation, pointing out that the transaction was one of the most profitable ever for the state-owned bank and that the loan had been fully paid before it was due.

“Mr. Ongpin’s imputations against me are false and malicious. His public threat of disbarment is an obvious attempt to embarrass me and our law firm and to divert the public’s attention from the real issue,” Acorda said in her statement.

She said Ongpin should “deal directly” with the message instead of “shooting the messenger.”

“How can his undercapitalized company named Delta Ventures, with a paid-up capital of P625,000, losses of P98 million and retained earnings of negative P2.3 million, obtain humongous loans amounting to P660 million from a government bank like DBP with extraordinary speed?” she asked.

“Let him explain that to the Ombudsman,” she said.

“It is shocking that DBP’s board even waived the evaluation of Delta Ventures’ financial capacity to repay the loan, which is a basic precondition to the approval of loans,” Acorda said.

“It is equally appalling that Delta Ventures was allowed by DBP’s officers to withdraw its collateral even if the P510 million loan was still unpaid, thereby leaving said loan without collateral whatsoever during the period when the original collateral was withdrawn,” she added. “Clearly, DBP’s officers bent over backwards just to accommodate Mr. Ongpin’s company and enable it to reap huge profits, even if it will expose the Bank to high lending risks.”