MANILA, Philippines — The local stock barometer rose slightly firmed up on Tuesday but gains were capped by caution over an upcoming US jobs data that might influence the timing of US Federal Reserve’s tapering of easy money policy.

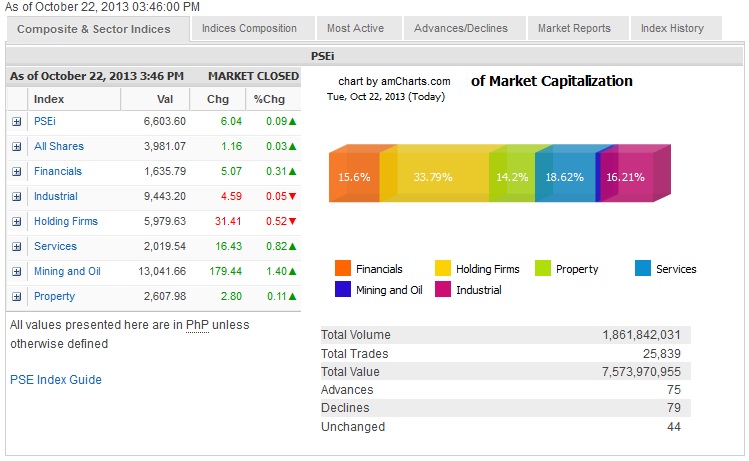

The main-share Philippine Stock Exchange index clawed back 6.04 points or 0.09 percent to close at 6,603.60 after Monday’s pullback.

Across the region, sentiment was mixed as investors awaited a crucial US jobs data that might determine how soon the US Fed would taper its aggressive bond-buying operations.

Apart from external concerns, a heavy pipeline of initial public offerings (IPOs) is sapping some liquidity from the market. Gaming and entertainment firm Travellers began on Tuesday a domestic offering which will run until October 29. The listing date on the Philippine Stock Exchange under the stock symbol “RWM” after the $473 million IPO is expected by November 5.

By counter, the day’s gains were led by mining/oil counter, which gained by 1.4 percent while the financial, services and property counters also firmed up. On the other hand, the industrial and holding firm counters ended in the red.

Value turnover for the day amounted to P7.57 billion. Despite the overall PSEi gain, there were slightly more decliners (79) than advancers (75) in the market.

The day’s gains were led by Semirara and Philex, which both rose by 3 percent while Globe and AEV were up by over 2 percent. SM Prime, URC and PLDT rose by over 1 percent.

On the other hand, the day’s laggers were MWC and Petron, which slipped by over 2 percent. JGS, MPI and Megaworld fell by over 1 percent.