MANILA, Philippines—The Philippine Stock Exchange (PSE) sees total fundraising activity for the year at “below” P200 billion compared to last year’s record P219 billion, as several deals were deferred due to volatile conditions in global markets.

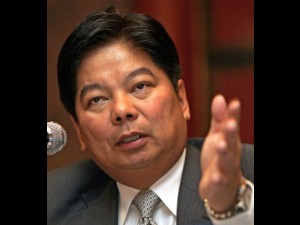

PSE president Hans Sicat told reporters that some of the larger equity transactions were returning, but the timing suggested that original assumptions would not be met.

“The market is only now picking up. In the next four weeks, you will see three IPOs [initial public offerings], two of them relatively larger ones,” Sicat said on the sidelines of the inaugural Rising Stars of the Philippines Forum organized by AsianInvestor and FinanceAsia.

“There are also a couple more private placement-type deals being done,” he said. “But the calendar means we will run out of time in terms of other fundraising transactions.”

Upcoming IPOs include Travellers International Hotel Group Inc. (P20.4 billion), Robinsons Retail Holdings (P32 billion) Harbor Star Shipping Services Inc. (P341 million) and Concepcion Industrial Corp. (P2.4 billion).

Earlier this year, Philippine Business Bank, Asia United Bank Corp. and AG Finance Inc. also went public while Del Monte Pacific Ltd. listed by way of introduction.

Sicat, meanwhile, said the bourse continued to be in merger discussions with fixed-income trading platform Philippine Dealing & Exchange Corp. (PDEx) although an anti-monopoly suit filed against the latter “complicates the process.”

“We are still working closely with other stakeholders in terms of what the results will be,” Sicat said.

PDEx’s operation was challenged at the Supreme Court by former government technocrats and lawmakers who accused financial regulators, PDS and the Bankers Association of the Philippines (BAP) of conspiring to create a “monopoly” in the bond market.

The issues were raised by petitioners Sen. Aquilino Pimentel Jr., former congressman Luis Villafuerte, former Budget Secretary Benjamin Diokno, and former national treasurers Norma Lasala and Caridad Valdehuesa.

Philippine Dealing System Holdings Corp., which operates PDEx, said in response that these issues had already been the subject of hearings conducted several times by the House of Representatives and the Senate.