MANILA, Philippines — The Philippine stock index climbed back to the 6,500 level on Thursday after US legislators struck a last-minute deal to raise the American federal government’s debt ceiling, thereby averting a potential US debt default and economic recession.

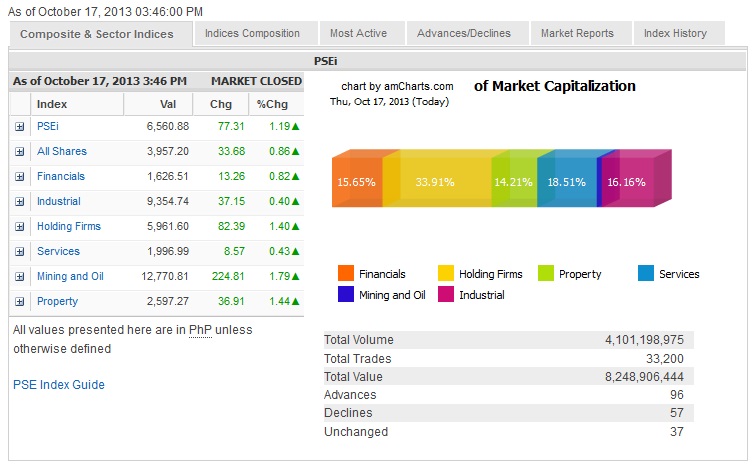

The main-share Philippine Stock Exchange index gained 77.31 points or 1.19 percent to close at 6,560.88 as US congress beat an October 17 deadline to increase the debt ceiling. The Federal government has been partially shut down for three weeks now as US politicians debated the government’s budget.

“This removes the uncertainty. People were anticipating a Lehman-like crisis because of a (potential) liquidity crunch that would have hit investor confidence. This averted that situation and the lifting of the debt ceiling also avoided a potential recession in the US,” said April Lee-Tan, head of research at local stock brokerage firm COL Financial.

All counters were up, led by the holding firm, mining/oil and property sub-sectors, which all gained by over 1 percent.

Turnover stood at P8.25 billion.

There were 96 advancers against 57 decliners while 37 stocks were unchanged.

The day’s biggest gainer among PSEi stocks was SMC (+5 percent) which announced the declaration of shares in controlling stockholder Top Frontier as property dividends.

Another big gainer was Semirara (+4.48 percent) while MPI, GTCAP, RLC and Globe Telecom all gained by over 3 percent. AGI, DMCI, AEV and EDC advanced by over 2 percent.

Outside of PSEi stocks, Emperador (+3.48 percent) and PNB (+1.82 percent) advanced in relatively heavy volume.

On the other hand, the day’s biggest PSEi lagger was LTG (-2.67 percent) while shares of MWC, PLDT, Bloomberry and JGS also faltered.