MANILA, Philippines — The local stock index went up on Wednesday but failed to breach 6,500 at the finish line as risk-taking was tempered by the nearing October 17 deadline for the United States to raise its public debt ceiling.

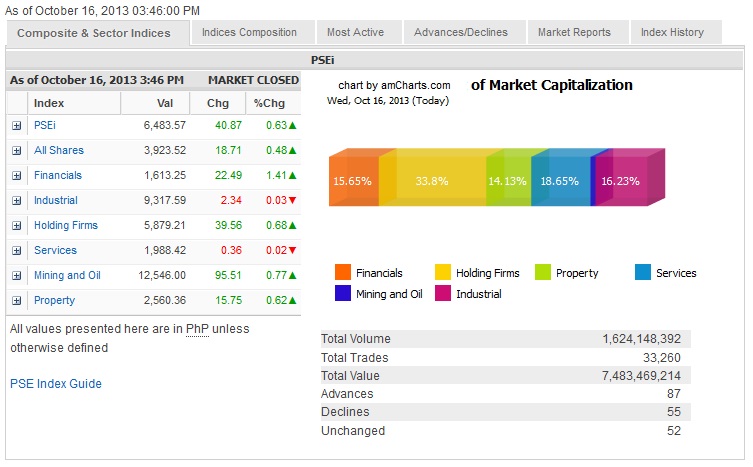

The main-share Philippine Stock Exchange index added 40.87 points or 0.63 percent to close at 6,483.57. An intra-day high was hit at 6,503.26 but investors held back apparently amid fears that failure by the United States to increase its debt ceiling could lead to a default on debt payments. Most analysts, however, were optimistic that US politicians could strike a last-minute deal as they did in 2011 to avert a debt crisis.

The day’s gains were led by the financial counter (+1.41 percent) while holding firms, mining/oil and property counters also added to the day’s gains. On the other hand, the industrial and services counters were slightly lower.

Turnover amounted to P7.48 billion.

There were 87 advancers against 55 decliners while 52 stocks were unchanged.

The day’s biggest PSEi gainers were DMCI (+4 percent) and MPI (+3.7 percent) while Metrobank, AEV, Semirara and BDO all gained by over 2 percent. AP and BPI rose by over 1 percent while SM Prime and Globe also contributed to the day’s gains.

The most actively traded stock was PLDT (-0.35 percent), followed by Metrobank, URC (+0.08 percent) and ICTSI (+0.6 percent).

Outside of PSEi stocks, those that gained in heavy volume were Puregold (+1.1 percent), Emperador (+1.95 percent) and Vista Land (+0.88 percent).