With just days to go before Washington runs out of cash to pay its bills, Republicans and Democrats said they were close to an agreement to end a stand-off that has shut the government for two weeks.

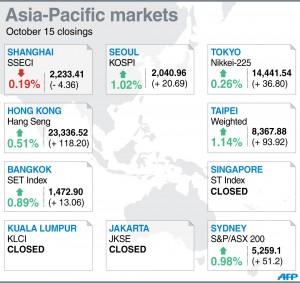

Tokyo rose 0.26 percent, or 36.80 points, to 14,441.54, Sydney closed 0.98 percent, or 51.2 points, higher at 5,259.1 and Seoul ended 1.02 percent higher, adding 20.69 points to 2,040.96. In the afternoon Hong Kong was up 0.55 percent.

However, Shanghai eased 0.19 percent, slipping 4.36 points to 2,233.41.

Jakarta, Kuala Lumpur, Manila and Singapore were closed for public holidays.

After weeks of bickering between the two sides Senate Majority leader Harry Reid and his Republican opposite number Mitch McConnell conducted low-key talks they said had finally borne fruit.

“I’m very optimistic we will reach an agreement that’s reasonable in nature this week to reopen the government, pay the nation’s bills and begin long-term negotiations to put our country on sound fiscal footing,” Reid said.

While expectations have been for a deal to be made—equities have remained buoyant despite the gridlock—the news will come as a relief because a US default would send global markets tumbling and likely spark another worldwide recession.

“It’s not like the US can’t afford to pay its bills, it’s more like its wife has just hidden its chequebook,” said CLSA equity strategist Nicholas Smith.

“Most fund managers appear to be more frightened of being left behind if the market (surges) than of the apocalyptic scenario of failing to fix the debt ceiling on time.”

Wall Street ended higher as investors cheered the progress, with the Dow climbing 0.42 percent, the S&P 500 up 0.41 percent and the Nasdaq adding 0.62 percent.

Despite the growing hopes for a breakthrough soon the dollar slipped as investors look past the debt crisis and to the Federal Reserve’s next move on its stimulus.

With fiscal dove Janet Yellen nominated to take over as chairman of the central bank investors expect the bond-buying scheme to be kept in place a little longer, keeping downward pressure on the dollar.

The greenback bought 98.40 yen in afternoon trade, against 98.67 yen in New York Monday, while the euro fetched $1.3567 and 133.51 yen compared with $1.3559 and 133.79 yen.

On oil markets New York’s main contract, West Texas Intermediate (WTI) for delivery in November, fell 27 cents to $102.14 a barrel, while Brent North Sea crude for November shed 27 cents to $110.77 a barrel.

Gold cost $1,257.56 at 1038 GMT compared with $1,281.60 on Monday.

In other markets:

— Taipei added 1.14 percent, or 93.92 points, to end at 8,367.88.

Taiwan Semiconductor Manufacturing Co. rose 1.9 percent to Tw$107.0 while Hon Hai fell 0.27 percent to Tw$73.8.

— Wellington rose 0.29 percent, or 13.76 points, to 4,747.93.

Telecom was up 0.22 percent at NZ$2.30, Air New Zealand gained 0.34 percent to NZ$1.49 and Warehouse Group was steady at NZ$3.70.

— Bangkok gained 0.89 percent, or 13.06 points, to 1,472.90.

Coal producer Bangpu rose 3.48 percent to 29.75 baht while Bangkok bank edged up 0.98 percent to 207 baht.

— Mumbai fell 0.29 percent, or 59.92 points, to 20,547.62.

Bank of India plunged 6.47 percent to 174.30 rupees while private HDFC Bank fell 2.37 percent to 651.40 rupees.