MANILA, Philippines—The local stock barometer had a rough start but ended in positive territory for the sixth straight session on Tuesday on selective buying of large-cap stocks.

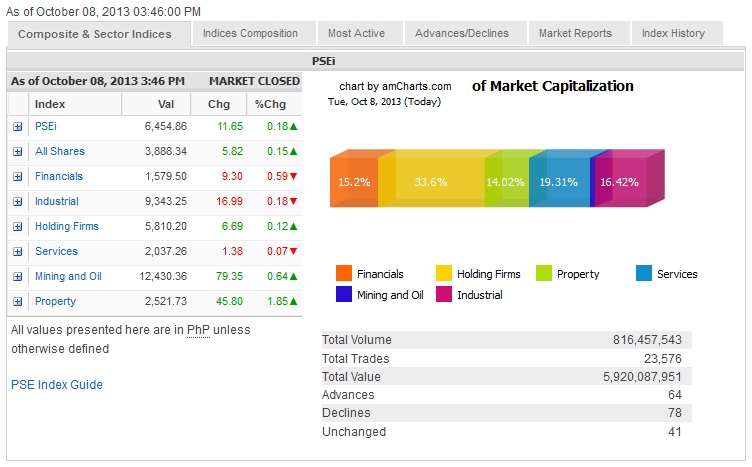

The main-share Philippine Stock Exchange index firmed up by 11.65 points or 0.18 percent to close at 6,454.86, tracking the rebound across regional equity markets.

“Early losses were reversed as investors bought selective blue chips as the market ended in green territory..(the) likely reason was the World Bank’s upgrade on Philippine economic prospects,” said Ricky Liboro, director at BPITrade.com.

However, Liboro noted that the market again traded on relative thin volume, with value turnover at P5.6 billion.

By counter, the property sub-index (+1.85 percent) led the day’s advance while holding firms and mining/oil counters also firmed up, compensating for the decline in the financial, industrial and services counters.

Despite the increase in the main-share index, there were more decliners (78) than advancers (64) in the broader market.

ALI (+3.3 percent) was the day’s biggest PSEi gainer while Philex, AGI and Bloomberry all gained by more than 2 percent. SM Prime and Megaworld jumped by over 1 percent while DMCI, SMC, GTCAP and SMIC also contributed to the day’s gains.

Among non-index stocks, Emperador (+4.98 percent) gained in relatively high volume.

Meanwhile, the day’s biggest PSEi laggers were Petron (-2.31 percent), RLC (-1.4 percent) and AEV (-1.25 percent).