Where is the market headed?

A: It seems like the outlook on the Philippine stock market will remain uncertain in the next few weeks as the global market appears to be in a state of confusion after the US Fed decided not to implement its widely expected plan to reduce its asset purchases last month. It can be recalled that many months ago, the US Fed has announced its intention to slow down the monthly infusion of new money into the system to stimulate growth, known as Quantitative Easing (QE), because the economy then was already showing signs of early recovery.

That announcement has resulted in rising interest rates and that was even before the so-called tapering plan started. The US Fed now fears that tapering quantitative easing early may result in higher mortgage rates which can hurt the economy. There is no clear market consensus at the moment as to when the tapering process will finally begin. The next US Fed meeting to decide the tapering plan will be at the end of October. It may or may not taper depending on the results of key economic data.

With this uncertainty looming into the horizon, market players have opted to lie low. Some people say that US Fed Chair Bernanke may be avoiding the responsibility to withdraw from the QE program, which can potentially create collateral damage during the transition, since he is set to retire in January next year. Considering that this may be the likely scenario, there may be no tapering until next year.

So how will this affect our market? If the market expects there will be no tapering after all because the US Fed may have misread the situation, interest rates may start to come down and foreign funds that left us few months ago may start to trickle back into our market. That is the scenario we hope to see, but the way it stands now, it appears that the tapering will happen in just a matter of time.

The issue of tapering, coupled by the current tension over debt ceiling debate and the short-term crisis being created by the government shutdown in the United States, has put the global investing community in a wait-and-see mode. The more unpredictable the market becomes, the higher the risk premium that will be required. This premium translates into higher target of investment returns to compensate for the extra risk brought about by uncertainties.

Article continues after this advertisementFor example, you plan to buy a stock with P/E of 19x. To get its investment yield, simply reverse the ratio to earnings over share price and you will get 5.3 percent. Now, if you require higher investment returns, you would demand higher yield, say 8 percent, which translates to lower P/E valuation of 12x. The higher the investment returns you demand, the lower the P/E you should aim for.

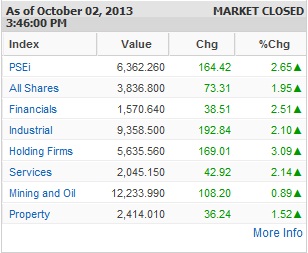

Article continues after this advertisementThe P/E of the Philippine stock market at the moment stands at 18.7x, still relatively expensive compared to Singapore, which has a market P/E of 13x or Hong Kong with a P/E of only 11x. Despite the fact that the market has already declined by over 20 percent from its all-time high, it is possible that it may fall further given the rising risk premium and high valuation.

Assuming there are no earnings upgrade that will significantly improve the current valuation in the short term, putting our market P/E at par with our neighboring stock markets in Asia, say at 15x valuation, will theoretically require the index to fall to 5,100 level.

Of course, this will not happen overnight. It may or may not reach this low but it is very clear from valuation standpoint that this market is bound to fall deeper. So what should you do?

Expect the market to be highly volatile with sharp swings as investor sentiment becomes extra sensitive to global developments. Yes, it may be risky but this is not the time to avoid it. In fact, this is the best time to buy stocks at the price you want.

If you are a long-term type of an investor who prefers to buy and hold, this is your chance to buy blue chips at bargain prices. Buy stocks that have high dividend yields for safety. If you are the short-term type, you can take advantage of the short-term volatility in stock prices by trading in and out. Buy high beta stocks that have been badly beaten and sell this when market rallies. By the way, you may need extra skills in charting and lots of time to monitor stock market daily if you want to do short-term trading.

There is no need to rush in buying stocks when market falls. Start to look for bargains when the market drops below 6,000 level. Screen stocks that have fallen by at least 25 percent from their all-time highs as your potential buying targets. Set your own criteria in selecting stocks. You can buy stocks that have P/E below market average.

You can also consider buying those with good track record not only fundamentally but marketability. Does the stock enjoy market following? Does it belong to the PSE index? How much is the stock’s market capitalization?

It is true that it is exciting to invest in the stock market when it is going up, but it can be more fun when the market is falling because this is the time when you can find the best value.

Henry Ong is registered financial planner of RFP Philippines. To learn more about financial planning and how to become RFP, attend a free personal talk on Oct. 10, 7 p.m., at PSE Ortigas. E-mail [email protected] or text <name><email> <RFPinfo> to 0917-3464126.