MANILA, Philippines – Lawmakers have filed a bill seeking to standardize rates of automated teller machine (ATM) transaction charges.

Bayan Muna Representatives Carlos Zarate and Neri Colmenares re-filed House Bill 2105 which “seeks to provide for a standard rate of transaction charges on ATMs and require the posting of said fees on ATM screens prior to the completion of any transaction” in a bid to protect users from hidden charges.

This comes after several banks announced an increase in the interbank ATM charges and a subsequent order by the Bangko Sentral ng Pilipinas (BSP) to halt the said plan.

“Banks already earn profits when the salaries and wages of workers are coursed through them by employers, they should not further extract profit from the workers who need every peso of their earnings,” Zarate said in a statement.

The first-term congressman said Congress should look into the issue to determine if the increase is indeed necessary.

Under HB 2105, the BSP will come up with rules and regulations detailing the standardization of fees.

“We want the BSP to explain even last year’s ATM increase, particularly by the BPI,” Zarate added.

On Thursday, the Philippine Daily Inquirer said the BSP’s Monetary Board had approved a memorandum stopping banks from hiking fees, pending a review of the actual costs incurred in interbank transactions.

BSP said that while they recognize the need for banks to recover costs, there is also a need to protect consumers.

In its earlier advisory, Henry Sy-owned BDO Unibank Inc. said the fee increase “is an industry-wide development to basically cover the cost of operating the ATMs.”

Local banks do not charge depositors for using their ATMs but apply a P10 to P15 usage fee for withdrawals made in other ATM networks.

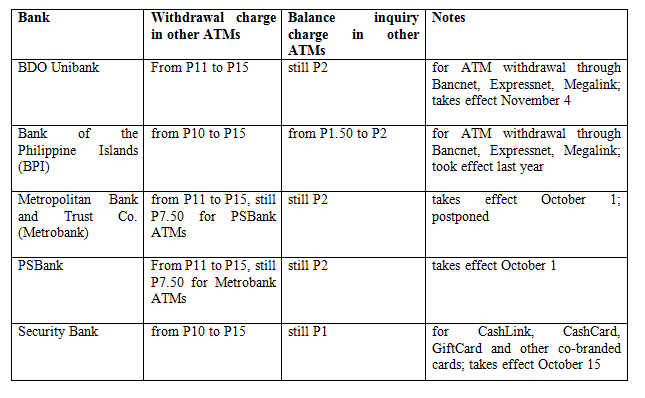

Announced increases to interbank ATM transactions are as follows:

In an advisory posted in their website, Metrobank announced the postponement of the new withdrawal charges “until further notice.”