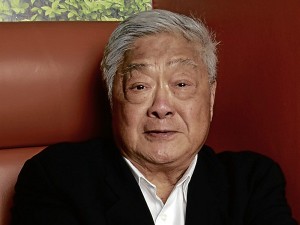

Conglomerate San Miguel Corp. is negotiating to sell its remaining 27.1-percent stake in Manila Electric Co. to the group of tycoon John Gokongwei, potentially completing its divestment from the country’s biggest power distributor.

SMC president Ramon Ang confirmed on Tuesday the long-running speculation that Gokongwei-led JG Summit Holdings Inc. could take over the group’s remaining stake in Meralco.

“Yes, [we are] in talks,” Ang said in a text message, when asked about the discussions with JG Summit on the sale of SMC’s Meralco stake.

Ang did not say whether SMC was likely to sell the entire block, which is worth P84 billion based on Tuesday morning’s price of P276.40 a share. SMC earlier said it would pare down its stake in Meralco in phases but stock analysts expect SMC to sell all of its remaining shares as a block this time around.

Other market sources estimated that JG Summit could be willing to buy out SMC at P245 a share for a total block price of about P75 billion. This will be a discount to Tuesday’s closing price of P277 per share, which valued SMC’s stake at around P84.6 billion.

SMC bought into Meralco in 2009 by acquiring shares collectively held by government corporations, including state-owned pension funds Government Service Insurance System (GSIS) and Social Security System (SSS), at P90 a share.

“It will be positive for San Miguel insofar as it will provide the company with a significant war chest to fund other operations,” said Manny Cruz, chief strategist at local stockbrokerage Asiasec Equities. Cruz said SMC could then rechannel proceeds to other businesses like infrastructure and oil sectors.

JG Summit president Lance Gokongwei previously denied that the conglomerate was interested in investing in Meralco. However, the Gokongwei group is widely seen as a potential buyer of SMC’s stake as a natural ally of the group of businessman Manuel V. Pangilinan, which holds the controlling interest in Meralco.

The Gokongwei group is a strategic investor in Pangilinan-led Philippine Long Distance Telephone Co. after a share-swap deal that consolidated Digital Telecommunications into the former.

Cruz said SMC’s divestment would be positive for Meralco as it would lift the overhang on shares.

“People are anticipating that SMC will eventually unload its shares. The last one was at P270 a share but the remaining stake is still sizable. If there’s going to be takers, it’s going to put out the overhang. That’s positive for Meralco, positive for SMC,” Cruz said.

Last June, SMC raised P17.4 billion from the sale to the open market of an initial 5.7-percent stake in Meralco at P270 a share in a placement deal arranged by Deutsche Bank and Standard Chartered.

For JG Summit, Cruz said a potential acquisition of Meralco shares would not have an immediate positive effect because the conglomerate would have to fund the transaction. “But over the medium- to long-term, it’s going to be positive despite (owning) a minority because it will benefit from Meralco’s cash flow.”

Related Stories:

John Gokongwei’s secret to being fit at 86? ‘I look at pretty legs’

Gokongwei’s JG Summit in Forbes Asia’s ‘Fab 50’ list